Credo Technology (CRDO) will release its second-quarter earnings results on Monday, Dec. 1. The stock has already delivered an impressive rally, rising 33.7% over the past three months and soaring over 138% so far this year. Much of that momentum in CRDO stock has been driven by strong demand for its high-speed connectivity solutions tied to the ongoing boom in artificial intelligence.

Even after that notable surge, Wall Street remains bullish. Most analysts still rate Credo as a “Strong Buy,” suggesting confidence that the company’s growth story is far from over. Technical indicators support that optimism as well. The stock’s 14-day Relative Strength Index sits below the typical overbought level, hinting that shares could still have more room to climb, especially if the upcoming results deliver positive surprises.

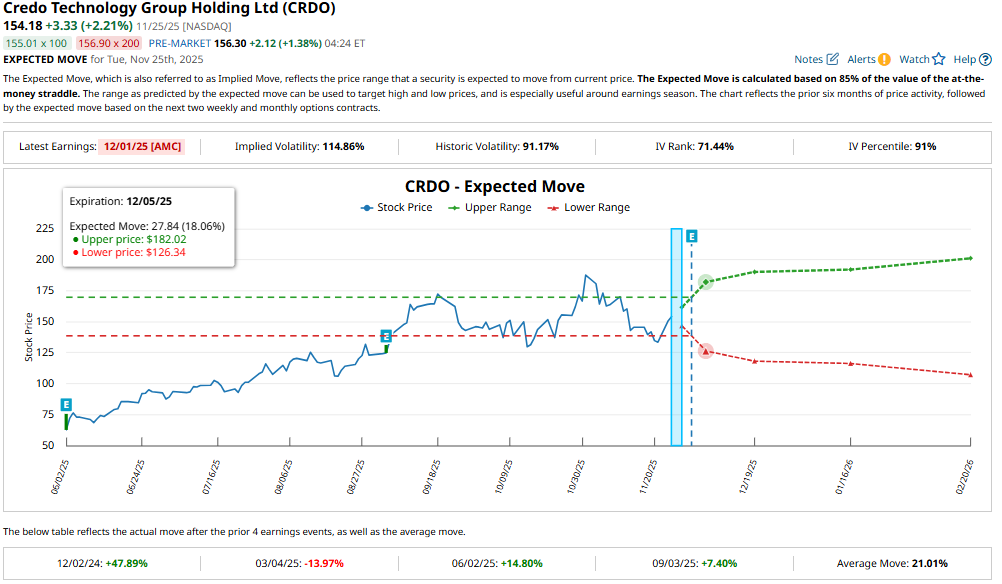

Options traders are anticipating a significant post-earnings move. Current pricing implies an 18.1% swing in either direction after earnings release for contracts expiring Dec. 5. Notably, CRDO stock jumped 7.4% following its last earnings update.

Credo Could Deliver Strong Q2 Revenue

After a solid start to fiscal 2026, Credo is likely to deliver strong growth in Q2 as well. Credo builds the high-speed, low-power connectivity hardware that keeps modern AI and cloud systems running efficiently. Its products include Active Electrical Cables (AECs), key integrated circuits, and advanced Serializer/Deserializer (SerDes) technology. As data demands surge, so does the need for Credo’s solutions.

Management has guided Q2 revenue to be between $230 million and $240 million. The guidance reflects a massive jump from the $72 million recorded a year earlier. CRDO's top-line growth is likely to be driven by increased adoption of its power-efficient, high-speed connectivity products as hyperscale cloud operators and data center customers accelerate investments in AI-driven infrastructure.

While a few major customers still account for a large share of revenue, Credo anticipates a more diversified customer base over the coming quarters as additional hyperscalers and data center partners ramp up purchases. With strong demand fundamentals and expanding customer reach, Credo is capturing a growing share of the AI and cloud infrastructure market.

AECs could once again remain the star of Credo’s portfolio. Their energy efficiency and cost advantages make them an attractive option for companies building massive AI clusters trying to minimize power consumption. Credo already counts three hyperscalers as significant AEC customers, and a fourth has recently begun contributing revenue, further solidifying the company’s leadership in this fast-moving market.

The company is also benefiting from rising demand in optical connectivity. Its digital signal processing technology for optical modules is gaining strong traction, putting Credo on track to double optical-related revenue in fiscal 2026. Meanwhile, its retimer product line, designed to improve data reach and latency in AI servers and switching systems, is witnessing momentum. Early wins for its PCIe retimers suggest another growth engine taking shape for the company, with revenue expected to kick in meaningfully in 2026.

Overall, Credo’s growth pipeline appears well-aligned with the ongoing buildout of AI hardware infrastructure. As data centers shift to higher-bandwidth, lower-power architectures, demand for Credo’s solutions should remain strong. Management expects continued strong year-over-year growth from its top customers in fiscal 2026, with revenue increasingly spread across a larger base of buyers.

Is CRDO Stock a Buy?

The momentum in Credo’s business will sustain in Q2, driven by strong demand for power-efficient high-speed connectivity products. Further, with growth expected to come from additional avenues such as optical connectivity and PCIe retimers, and its customer base expanding, Credo has multiple catalysts to support its share price.

Credo is still in the early innings of its growth story and stands to benefit from the ongoing buildout of AI infrastructure. Further, the recent pullback in its share price presents a solid entry point.

On the date of publication, Amit Singh did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart

- ‘These Chips Will Profoundly Change the World’ and ‘Save Lives.’ Elon Musk Doubles Down on AI Chips as TSLA Stock Stagnates YTD.

- This Undiscovered Biotech Stock Has Quintupled in a Year and Just Hit New Highs

- Oppenheimer Thinks Investors Are Missing Out on IBM Stock

- Wedbush Just Raised Its Fannie Mae Price Target 1,050%. Should You Buy FNMA Stock Here?