Alibaba (BABA) released its Q2 2026 earnings yesterday, Nov. 25. The stock whipsawed after that report, but eventually closed lower, as it beat on the top line but missed earnings-per-share (EPS) estimates. Moreover, its adjusted earnings before interest, tax, depreciation, and amortization (EBITDA) fell by a whopping 78% year-over-year. The company’s adjusted EBITDA saw a double-digit dip in the previous quarter, as well.

Meanwhile, despite the pressure on profitability, BABA stock is up a cool 85% for the year as of Nov. 25 closing prices. The price action might seem at odds with the declining profitability. Still, investors have poured money into the Chinese tech giant this year as it has emerged as the preeminent AI play in the world’s second-biggest economy, which Nvidia (NVDA) CEO Jensen Huang said “will win in AI race” before toning down his prediction.

In this article, we’ll discuss whether you should buy the dip in Alibaba or stay away amid pressure on its bottomline.

Why Are Alibaba’s Profits Tanking?

Alibaba’s investments in the rapidly growing instant commerce business are the predominant reason its profits are tanking. In fact, if not for that business, Alibaba said that its e-commerce group’s EBITDA would have expanded by mid-single digits in the September quarter.

The company has been offering subsidies to consumers to spur adoption in instant commerce, a segment that is witnessing intense competitive rivalry in China. However, while the instant commerce segment is currently dragging down Alibaba’s profits, it should help buoy earnings over the long term. Through economies of scale and higher average order values, Alibaba is seeing an improvement in the unit economics of that business, and we should see further progress in the coming quarters.

Why Is BABA Stock a Buy?

Let’s now dig into Alibaba’s valuations. The stock trades at a forward price-earnings (P/E) multiple of nearly 26x, which might look bloated as the stock was trading at single-digit P/Es a few quarters back. However, that argument misses three points. Firstly, the low-single-digit multiples were not apt for a tech company like Alibaba, and with China now making a U-turn and backing its domestic tech giants after the brutal 2021 crackdown, the valuations of Chinese shares have seen a positive re-rating.

Second, Alibaba should get some valuation respect given its progress in AI. Its Qwen app surpassed 10 million downloads in the first week of beta launch, and it is the only Chinese company with a prominent large language model and ecommerce operations. Alibaba has further cemented its position in China’s AI cloud market with a market share higher than the next three competitors. The company has emerged as a worthy competitor to Western AI rivals and even developed AI chips, which would not only help it lower reliance on third parties but could potentially become a significant business line as it signs up third-party customers.

Finally, Alibaba’s current valuations appear high as its earnings have tanked, which is pushing up the multiples. The company’s profits should eventually move higher as it leverages AI in other businesses and its cloud business continues to benefit from growing demand. The losses in Alibaba's instant commerce business should also eventually taper down, which will help boost its profits.

BABA Stock Forecast

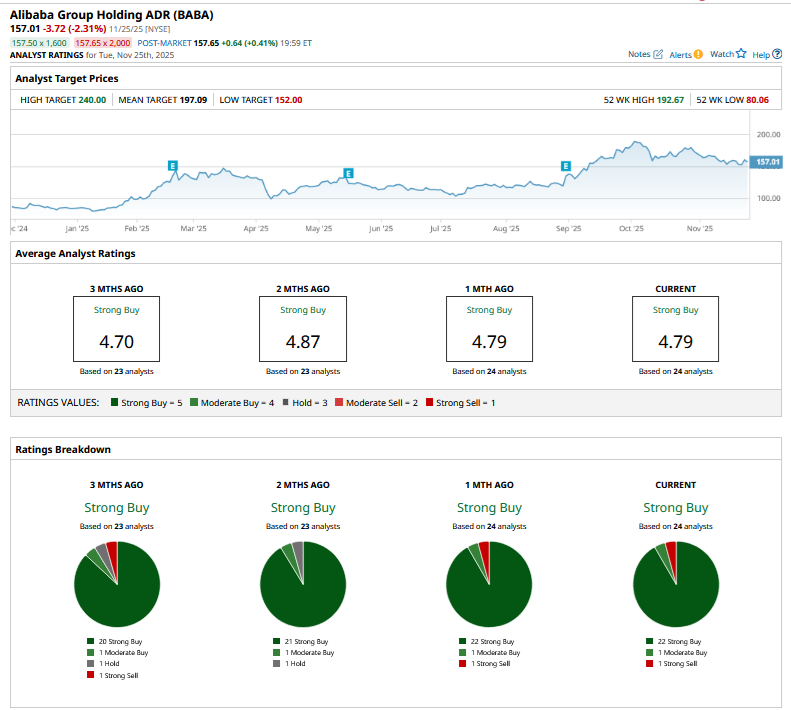

Sell-side analysts are also on the same page, and Alibaba’s mean target price of $195.29 is 23% higher than the current price, while the Street-high target price of $240 is nearly 52% higher. The stock – which has a consensus rating of “Strong Buy” from the 24 analysts polled by Barchart – is now very close to its Street-low target price of $152, reflecting the extreme pessimism.

In my previous article, I had noted that there was an apparent FOMO trade in Alibaba as the stock, which looked “uninvestible” after the tech crackdown, became a market darling as a China AI play. While the valuations were not in a bubble zone even at 2025 highs, the stock looks a lot more grounded after the over-18% drawdown from the peak.

Overall, I remain bullish on BABA stock and used the recent fall to add more shares, and would consider adding even more if the stock falls further, which would make it only more attractive.

On the date of publication, Mohit Oberoi had a position in: BABA , NVDA . All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart