Scottsdale, Arizona-based Axon Enterprise, Inc. (AXON) develops advanced technology and weapons products for law enforcement, military, and civilian use. With a market cap of $41.2 billion, Axon is renowned for its TASER devices, body-worn cameras, and cloud-based evidence management solutions, which are pivotal in modern public safety.

Axon has significantly underperformed the broader market over the past year. Its stock prices have declined 12.2% on a YTD basis and plunged 17.3% over the past 52 weeks, compared to the S&P 500 Index’s ($SPX) 12.3% gains in 2025 and 11% returns over the past year.

Narrowing the focus, Axon has also underperformed the industry-focused Industrial Select Sector SPDR Fund’s (XLI) 13.6% surge on a YTD basis and 6.4% uptick over the past year.

Axon Enterprise’s stock prices plunged 9.4% in the trading session following the release of its lackluster Q3 results on Nov. 4. The company has continued to observe significant growth in its recurring revenues. Its topline for the quarter grew 6.3% year-over-year to $710.6 million, beating the Street’s expectations by 1.6%. However, the company has failed to project its margins, leading to a massive 44.8% drop in adjusted EPS to $1.17, missing the consensus estimates by a staggering 28.2%.

For the full fiscal 2025, ending in December, analysts expect Axon to deliver an adjusted EPS of $0.18, down 91.4% year-over-year. This company has a mixed earnings surprise history. While it surpassed the Street’s bottom-line estimates twice over the past four quarters, it missed the estimates on two other occasions.

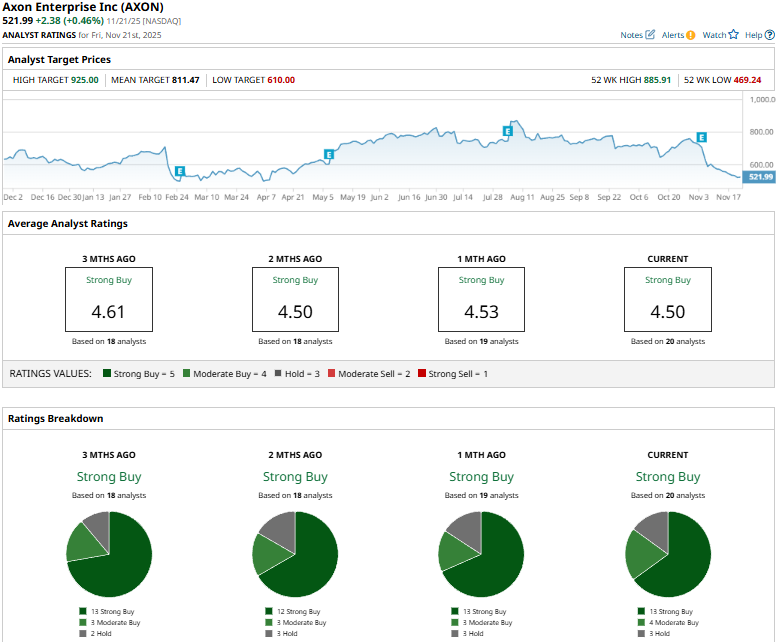

Among the 20 analysts covering the Axon stock, the consensus rating is a “Strong Buy.” That’s based on 13 “Strong Buys,” four “Moderate Buys,” and three “Holds.”

On Nov. 6, Barclays (BCS) analyst Tim Long maintained a “Buy” rating on Axon, but lowered the price target from $861 to $702.

As of writing, Axon’s mean price target of $811.47 represents a 55.5% premium to current price levels. Meanwhile, the street-high target of $925 suggests a massive 77.2% upside potential.

On the date of publication, Aditya Sarawgi did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart