Investors are glued to Eli Lilly (LLY) shares this morning as the pharmaceutical behemoth became the world’s first trillion-dollar healthcare company.

LLY has soared this year on the back of explosive demand for its obesity (Zepbound) and diabetes (Mounjaro) treatments, which together brought in over $10 billion in the company’s latest reported quarter.

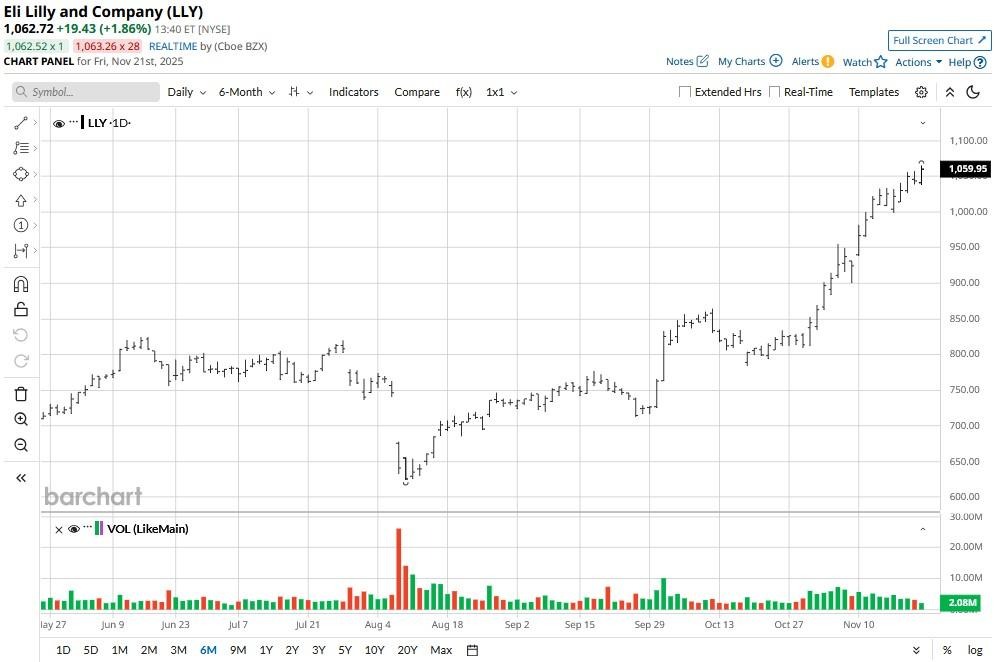

At the time of writing, Eli Lilly stock is up a whopping 70% versus its low in early August.

How High Can Eli Lilly Stock Go in 2026?

Despite a massive surge in LLY shares in recent months, Citi’s senior analyst Geoff Meacham sees them pushing higher as the company receives approval for its oral weight-loss pill in 2026.

According to him, expectations for orforglipron “have steadily risen given a competitive product profile, high consumer interest, and broadening access.”

Meacham expects the oral GLP-1 drug to generate up to $1.8 billion in revenue for Eli Lilly next year – and over $40 billion annually once sales peak.

Last week, he reiterated a “Buy” rating on the pharma stock and raised his price target to $1,500, indicating potential for nearly 45% upside from current levels.

Jim Cramer Remains Bullish on LLY Shares

Famed investor Jim Cramer also sees Eli Lilly shares rallying to record levels in 2026. He expects the firm’s recent deal with President Donald Trump’s administration to prove a material catalyst for the healthcare giant.

The said agreement reduces GLP-1 pricing to around $245 per month for Medicare and Medicaid patient and offers discounted access via TrumpRx, expanding coverage to millions who previously lacked access.

This huge volume boost despite lower prices will strengthen LLY’s leadership in the weight-loss category – potentially driving its share price much higher from here.

On CNBC, Cramer praised the company’s management for exploring new therapeutics areas like ALS as well.

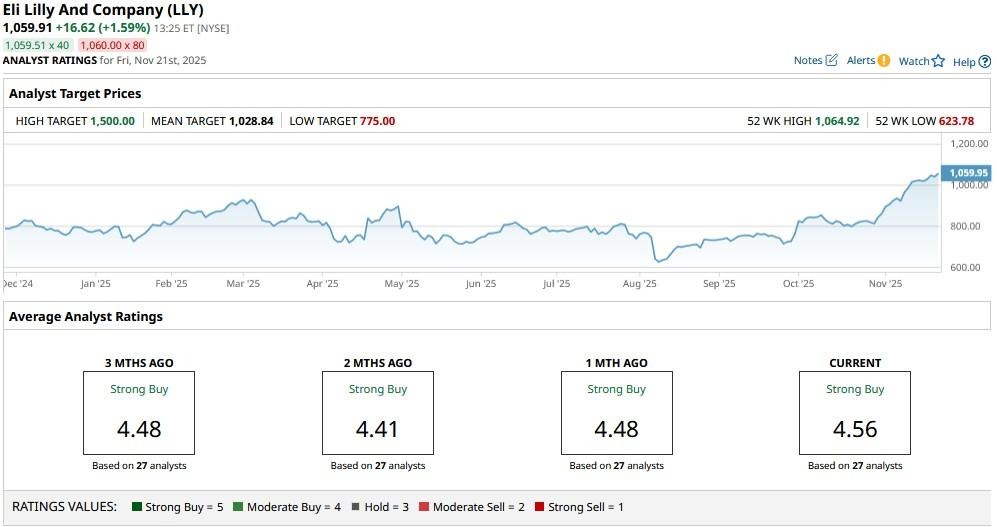

How Wall Street Recommends Playing Eli Lilly

While not nearly as bullish as Citigroup, other Wall Street firms recommend owning Eli Lilly stock heading into 2026 as well.

The consensus rating on LLY shares remains at “Strong Buy” as the titan’s price-sales (P/S) ratio of 22x is compelling given its exceptionally strong pipeline.

On the date of publication, Wajeeh Khan did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart

- With Earnings Behind It, Nvidia Stock Looks Ripe for Covered Calls

- Bitcoin Prices Are Falling, But MicroStrategy Is Not Sweating the Selloff. MSTR Stock Has a 71-Year Runway, According to Management.

- Eli Lilly Stock Just Joined the $1 Trillion Club. Should You Buy LLY Here?

- 3 Risks Investors Face Right Now and 2 Charts That Should Ease Your Stock Market Panic