Circle Internet Group (CRCL) is a leading global financial technology company specializing in stablecoin issuance and blockchain-based payment solutions. The company provides a comprehensive platform and network infrastructure for integrating digital currencies and public blockchains into business applications for payments, commerce, and financial services. Circle is known for issuing USDC, a U.S. dollar-pegged stablecoin that is widely used in digital asset ecosystems for seamless value transfer and liquidity.

Founded in 2013, Circle Internet Group is headquartered in New York City with operations across the U.S., Europe, and Asia-Pacific regions. The company went public in June earlier this year.

About CRCL Stock

Circle Internet Group has seen sharp volatility in 2025. Over the past five days, the stock has declined by roughly 15-20%, extending a near 50% drop over the last month as investors reassess rich valuations following strong Q3 results. Since the stock’s recent IPO, it is trading at its all-time low of $64.95, set earlier today.

The stock has widely underperformed the broader market, like the Russell 3000 Index, which, despite its recent struggles leading to a 25% decline in a month, has an over 10% return in the last six months and trades just 4% shy of its 52-week high.

Circle Internet Group Posts Q3 Results

Circle Internet Group reported strong third-quarter 2025 results on Mov. 12, with revenue reaching $740 million, a 66% year-over-year (YoY) increase, surpassing analyst estimates of around $708 million. Earnings per share came in at $0.64, significantly above the forecasted $0.22. The company's net income rose 202% to $214 million, and adjusted EBITDA increased 78% to $166 million, reflecting robust USDC stablecoin adoption and platform growth.

The quarter saw USDC circulation climb to $73.7 billion, up 108% YoY, with other revenue streams from subscriptions and transactions also growing strongly. Operating expenses increased by 70%, driven by higher compensation and strategic investments, with adjusted operating expenses rising by 35%. Cash flows remained healthy, supporting ongoing platform and partnership expansions, including the successful launch of the Arc public testnet involving over 100 companies.

For Q4, Circle remains optimistic, projecting continued revenue growth supported by accelerating digital currency adoption and strengthening partnerships, while investing heavily in technology and global expansion to capitalize on market opportunities in stablecoins, blockchain payments, and tokenized finance.

Cathie Wood Snaps Circle

Cathie Wood’s Ark Invest (ARKK) has continued its aggressive buying in crypto-related stocks amid a market pullback, purchasing over $39 million in shares of Bullish (BLSH), Bitmine (BMNR), and Circle Internet Group. Specifically, Ark Innovation ETF bought 150,518 shares of Circle, adding to a total acquisition of 216,019 shares of Circle across its various funds, signaling strong conviction despite Circle’s 8.9% slide on the day of purchase.

Circle’s shares have declined significantly from their mid-year highs, but Ark views the dip as a buying opportunity, reflecting confidence in Circle’s growth prospects in stablecoin issuance and blockchain financial infrastructure. This move occurred as Bitcoin (BTCUSD) dropped below the $90,000 mark, reflecting a cautious yet opportunistic stance amid a broader crypto market pullback.

This move aligns with Ark’s strategic shift toward digital asset infrastructure investments, balancing recent reductions in semiconductor positions. The continued build-up highlights Ark’s belief in the long-term potential of companies enabling cryptocurrency adoption even amid short-term volatility in crypto markets.

Should You Buy CRCL Stock Too?

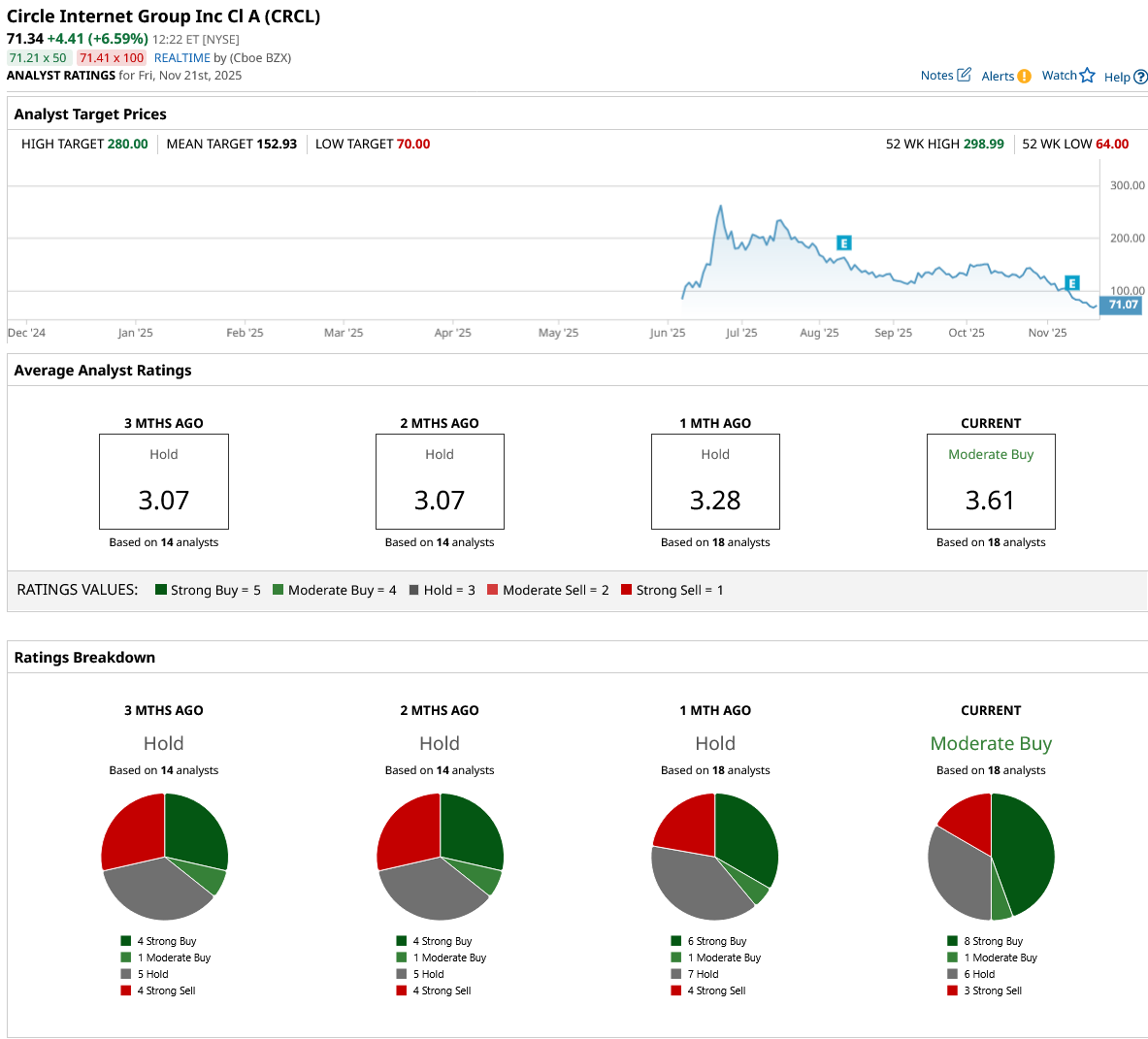

Circle Internet Group doesn’t have much in terms of support from Wall Street, but despite its struggles, CRLC stock has been upgraded from a consensus “Hold” rating last month to a “Moderate Buy” rating with a mean price target of $152.93, reflecting an upside potential of 129% from the market price.

CRCL stock has been rated by 18 analysts, receiving eight “Strong Buy” ratings, one “Moderate Buy” rating, six “Hold” ratings, and three “Strong Sell” ratings.

On the date of publication, Ruchi Gupta did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart

- 2025 Hasn’t Been Pleasant for Tesla Stock. Will 2026 Be Any Better?

- 3 Simple Options Strategies to Act on Thursday’s Unusual Activity Now

- The Bull Case for AI Stocks Is ‘Far Weaker’ Than You Think…At Least According to This Analyst. 1 Stock He’s Downgrading Now.

- This Little-Known Nuclear Energy Stock Is ‘the Most Important Company in America’