MicroStrategy (MSTR) shares are in focus today after the enterprise software firm, best known for its massive crypto holdings, said it has 71 years of dividend coverage even if Bitcoin (BTCUSD) prices remain flat.

MSTR stock has been under immense pressure amid a macro-driven sell-off in Bitcoin this month. On Friday, the world’s largest cryptocurrency by market cap was seen hovering around the $81,000 level.

At the time of writing, MicroStrategy stock is down an alarming 60% versus its high in mid-July.

Here’s What It Means for MicroStrategy Stock

The aforementioned disclosure highlights extraordinary resilience in the face of Bitcoin turbulence

According to MicroStrategy, “any BTC appreciation beyond 1.41% a year fully offsets our annual dividend obligations” that currently stand at $700 million.

For investors, the revelation is largely positive since it confirms that MSTR is not at risk of forced liquidation, strengthening confidence in its long-term HODL strategy.

It underscores management’s conviction in its Bitcoin treasury initiative and bolsters the case for owning MSTR shares despite crypto volatility.

Why Own MSTR Shares Heading Into 2026

MicroStrategy remains worth buying since a potential rebound in Bitcoin may trigger an explosive rally in its stock next year.

According to industry experts like Charles Hoskinson, BTC could soar to the $250,000 level by the end of 2026 as institutional capital continues to flow into the world’s first successfully cryptocurrency.

“There is no way for these markets to stay depressed forever … they’re just reflecting the current macro environment,” he said in a recent interview with CNBC.

Note that historically, MicroStrategy shares have delivered even better returns than Bitcoin itself during upcycles, acting as a leveraged proxy.

What’s the Consensus Rating on MicroStrategy?

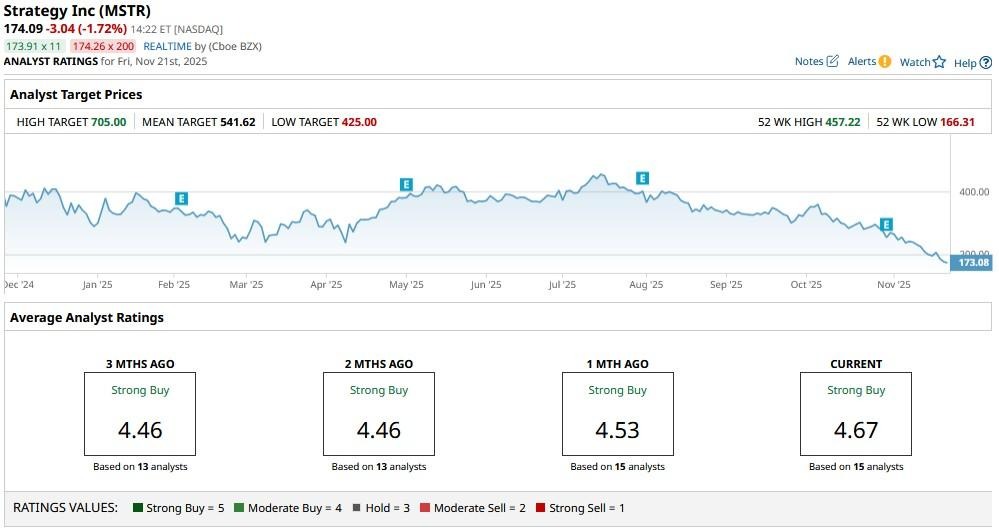

While MicroStrategy stock has crashed decisively below all of its major moving averages (50-day, 100-day, 200-day), Wall Street remains bullish on it heading into 2026.

According to Barchart, the consensus rating on MSTR shares sits at “Strong Buy” currently with the mean target of about $542 indicating potential upside of more than 200% from here.

On the date of publication, Wajeeh Khan did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart

- With Earnings Behind It, Nvidia Stock Looks Ripe for Covered Calls

- Bitcoin Prices Are Falling, But MicroStrategy Is Not Sweating the Selloff. MSTR Stock Has a 71-Year Runway, According to Management.

- Eli Lilly Stock Just Joined the $1 Trillion Club. Should You Buy LLY Here?

- 3 Risks Investors Face Right Now and 2 Charts That Should Ease Your Stock Market Panic