I woke up this morning feeling nostalgic. I realized it’s been three years and seven months since I wrote my first Barchart commentary about unusual options activity.

I’ve always emphasized that it doesn’t matter how long I’ve been writing about options; I still feel like a rookie, and I strive to keep learning.

So, I asked Perplexity -- don’t get me started about the best AI chatbot for answering financial questions -- the following question:

“Rate the top 10 options strategies for generating income on a scale of one to 10, with one being the least simple to execute and 10 being the most simple.”

The three simplest options strategies to execute according to Perplexity are Covered Calls (10), Cash-Secured Puts (9), and Bull Put Spread (8). While that’s self-evident to options veterans, it’s probably less so for those new to the financial derivative.

In yesterday’s column, I said that I would spend more time focusing on outside-of-the-box income-generating strategies. And, I will, but today I want to go with simple rather than complex. Most investors are better served by employing the KISS principle.

With that in mind, here are three unusually active options from Thursday to highlight the three simplest income-generating strategies listed above.

Have an excellent weekend.

Covered Call

The covered call is the most discussed and utilized income-generating strategy for retail and institutional investors alike. According to Morningstar, almost 80 covered-call ETFs have been launched since 2022, attracting more than $65 billion in the process.

A covered call involves owning shares in a company while also selling call options that expire at some point in the future, thereby receiving premium income. If done correctly, it can improve an investor’s annual return.

ETFs use the covered call options strategy to generate monthly income for the fund and, by extension, the investor. They can be an excellent way to create monthly passive income.

However, there are risks, the biggest being that your shares are called away if the share price is above the strike price at or before expiration. That caps your upside.

That’s not necessarily a bad thing, but it depends on your viewpoint about when to sell stocks you’ve held for the long term.

E.g., you bought XYZ stock two years ago at $50, and it’s now trading at $100. If you believe it’s better to let your winners run -- deferring capital gains in the process -- a cap isn’t your friend. However, if you don’t have a problem taking profits in the future, it can be.

So, to examine a covered call in action, I’ll find a stock with unusual options activity from Thursday.

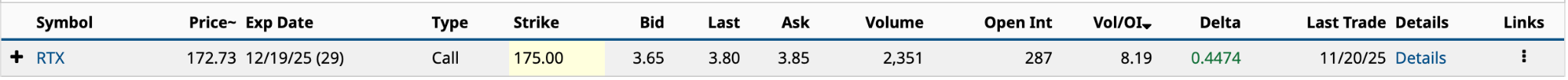

Yesterday, I wrote about RTX (RTX), the aerospace and defense company, whose shares are up nearly 50% year to date. It had two unusually active calls yesterday. Only one of them interests me.

The $175 strike expires in 29 days. Most sellers of calls like DTEs (days to expiration) between 30 and 60 days. It provides a balance between income received and a lower chance that the shares will be called away.

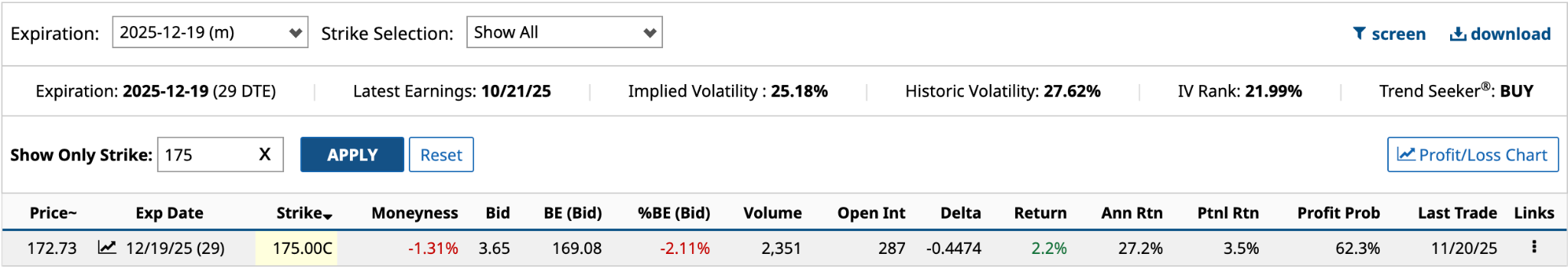

As you can see by the data above, the RTX share price at yesterday’s close was 1.31% OTM (out of the money). Ideally, on Dec. 19, you want the share price to be at $175, delivering maximum profit and an annualized return of 27.2%.

The annualized return is calculated as follows: $365 premium (bid price $3.65) / $17,273 (cost of 100 shares at $172.73) - $365 premium = $365 / $16,908 = 2.159% * 365 / 29 = 27.2%.

The trick here is pulling this off 8-12 times a year without your shares being called away. Conversely, what’s the worst outcome here?

You receive $365 in premium, you’re forced to sell your shares at $75, for a short-term capital gain of $592 [$365 premium + capital gain ($175 strike - $172.73)], and an after-tax return of 44.7% based on a 24% federal income tax rate [$592 / $16,681 [$17,273 cost of 100 shares - $592 (capital gain and premium)].

Note: I’m not a tax advisor. There are instances where you sell a call with a stock owned for more than a year, and you’re still required to pay the regular income tax on gains rather than the long-term rate.

Cash-Secured Puts

This next one shouldn’t take as long.

A cash-secured put involves selling a put ATM (at the money) or OTM for premium income while setting aside the cash needed to buy shares if the put is assigned to you. As a result, this options strategy is generally bullish. In addition to the income it generates, it can provide the opportunity to buy the stocks you want to own at better prices.

The biggest risk? The share price falls well below the strike price of the put at or before expiration, and the buyer forces you to buy shares at the much higher strike price.

From time to time, I write about Covered Combinations, or Covered Strangles, which combine covered calls with cash-secured puts. It gives you more income while establishing buy and sell points. It’s not a topic for today.

For an example of cash-secured puts from yesterday’s unusual options activity, I’ve zeroed in on puts expiring around 45 days on Dec. 26. Unfortunately, there were only five available, so I’ve widened the search. The Dec. 19 expiration (29 DTE) provides a bunch.

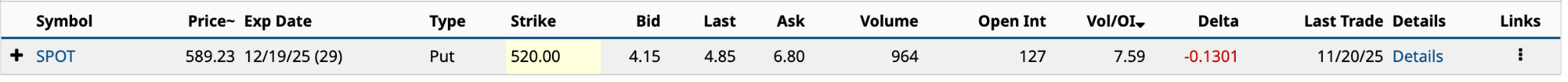

I’m a Spotify (SPOT) subscriber, so I’ll go with its Dec. 19 $520 put.

In yesterday’s trading, the $520 put had volume of 964, 7.59 times its Vol/OI (volume-to-open-interest) ratio. That’s not a massive amount for Spotify, whose average daily volume is 15,218. Nevertheless, I like the company, so we’ll run with it.

In yesterday’s trading, the $520 put had volume of 964, 7.59 times its Vol/OI (volume-to-open-interest) ratio. That’s not a massive amount for Spotify, whose average daily volume is 15,218. Nevertheless, I like the company, so we’ll run with it.

Year-to-date, its stock is up 31%. Over the past five years, it’s up 126%, which is okay, I guess, but I think it can do better. Its profits are definitely coming along. In Q3 2025, its key performance metrics were all higher, with free cash flow of $800 million, 13% higher than a year ago. In the trailing 12 months ended Sept. 30, its free cash flow was 2.92 billion euros ($3.36 billion), 28% higher than at the end of 2024.

There is no question that its business model has been proven successful. I don’t see that changing anytime soon.

As you can see, the $520 put is OTM by 11.7%. The expected move, up or down, over the next 29 days is 7.56%, so the profit probability on this put would be around 87%. That’s pretty good.

The return for selling the put would be 0.8% [$4.15 bid price or premium] / $520 strike price - $4.15 bid price]. The annualized return is 10.1% [0.8% * 365 / 29].

That’s a decent return. More importantly, were you required to buy 100 shares at expiration, your entry point would be $515.85, Spotify’s lowest price since April.

Bull Put Spread

The last of the least complicated income-generating options strategies is the bull put spread. It involves selling a short put option and buying another long at a lower strike price. Both have the same expiration date.

The strategy is used by those who are bullish on a stock and want to generate income. Further, the strategy has limited losses and limited profits, reducing risk but also capping the upside.

Here’s an unusually active option from yesterday to lay the foundation for a but put spread.

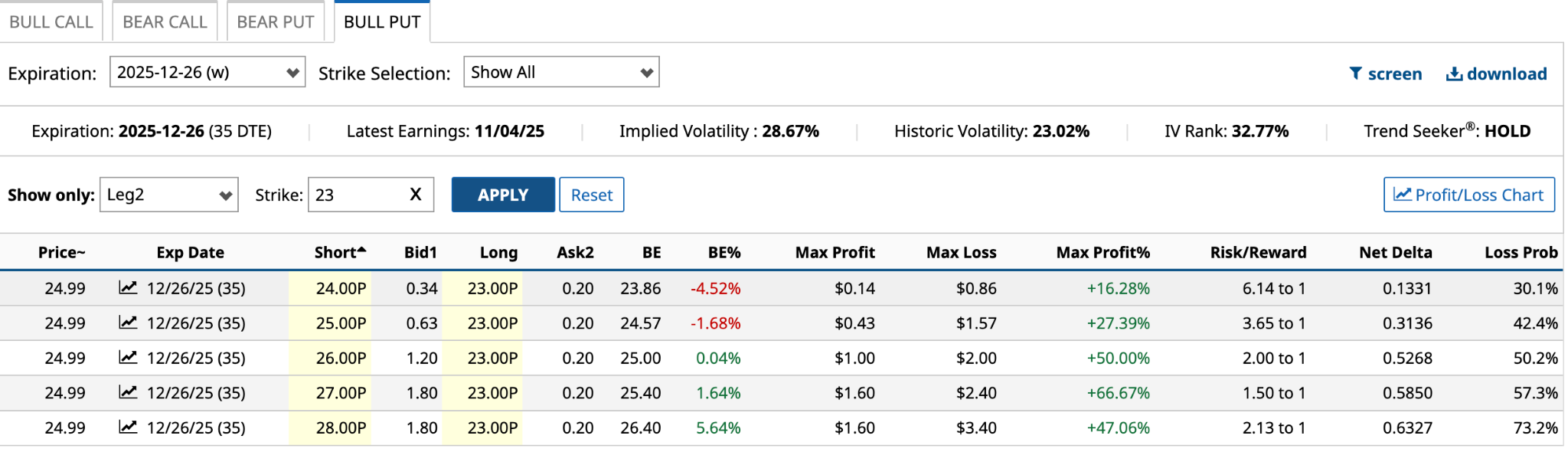

Pfizer’s (PFE) Dec. 26 $23 put had a Vol/OI ratio of 85.24 yesterday, the second-highest among options expiring in seven days or more. Pfizer’s been dead money for the better part of five years. However, based on the five-year chart below, it appears PFE stock may have bottomed in April at its 10-year low of $20.92.

I’m neither bullish nor bearish about Pfizer, although I probably lean bullish just because of its likelihood to revert to the mean at some point in the future.

Based on the $23 put strike, here are five possible bull put spread combinations.

The net credits of the five -- the difference between the short put premium received and long put premium paid -- range from $14 to $160. You’re probably thinking, “$14 is not worth my time, I want to go for the big money around $160.”

That’s not flawed thinking. But you have to balance home-run income with a realistic chance of success. E.g., while the short $28 put and $27 put have the same net credit of $1.60, the risk of the $28 put is substantially higher. So, you probably want to throw out the highest strike price.

If it were me, I might go for the short $26 put for two reasons: First, your maximum loss of $2.00 [$26 strike price - $23 strike price - $1.00 net credit] is 17% less than $27 short put. Secondly, your profit probability is 49.8%, 710 basis points above the $27 put.

You lower your potential loss by 17% while increasing your chance of success by 12%.

It’s not a sure thing, but the reward is definitely better than the $24 put.

On the date of publication, Will Ashworth did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart

- 2025 Hasn’t Been Pleasant for Tesla Stock. Will 2026 Be Any Better?

- 3 Simple Options Strategies to Act on Thursday’s Unusual Activity Now

- The Bull Case for AI Stocks Is ‘Far Weaker’ Than You Think…At Least According to This Analyst. 1 Stock He’s Downgrading Now.

- This Little-Known Nuclear Energy Stock Is ‘the Most Important Company in America’