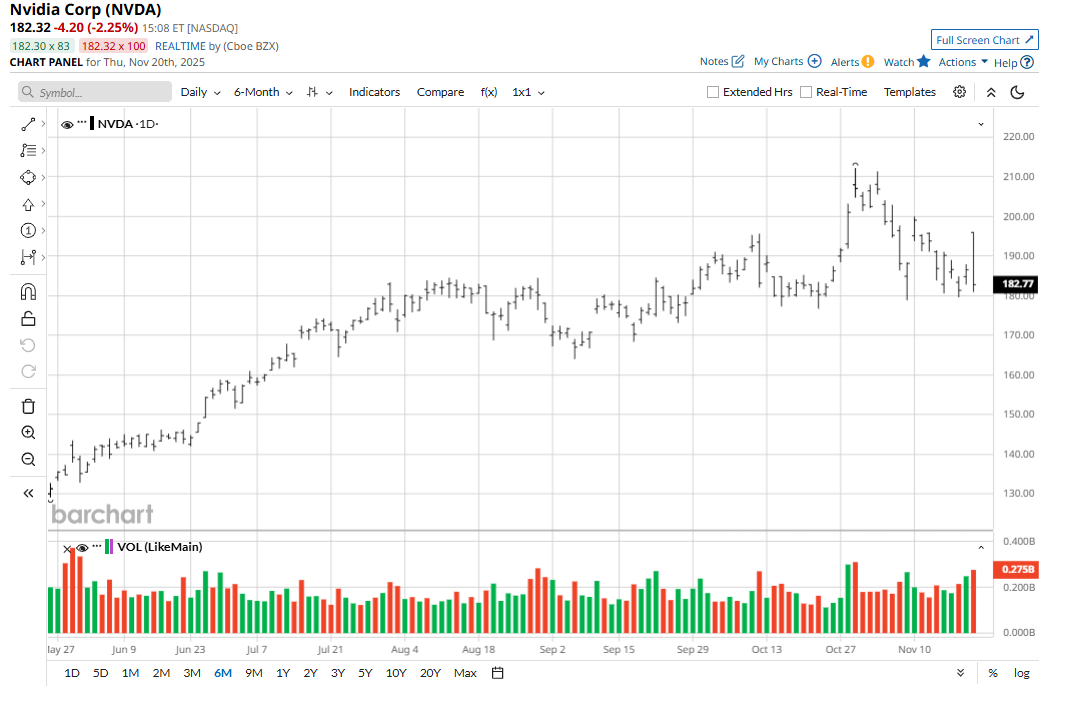

Up about 110% from its April low, Nvidia (NVDA) has been one of strongest tech giants on the market. All thanks to the artificial intelligence boom, related capex spending, and a potential multitrillion-dollar surge in AI infrastructure spending.

Each of these three drivers could easily send Nvidia to $350, even $400, by mid-2026.

- In fact, according to Loop Capital’s Ananda Baruah, NVDA stock could rally to $350, as the tech giant gets caught up in the AI demand boom that shows no signs of cooling.

- Goldman Sachs just raised its price target on NVDA to $250 with a “Buy” rating following Nvidia’s impressive earnings.

- Evercore ISI analysts raised their price target to $352 with an “Outperform” rating, citing accelerating revenue growth and improvements with product availability.

$350 Is an Easy Target for Nvidia Stock

Fueling a good deal of momentum has been the AI boom, capex spending, data center growth, and the blowout earnings and guidance we just saw.

Earlier this week, Nvidia posted EPS of $1.30, which beat estimates by $0.04. Revenue of $57 billion, up 62% year over year, beat by $1.91 billion.

Data center revenue of $51.2 billion was up 25% quarter over quarter, and up 66% year over year.

Even better, CEO Jensen Huang noted, “Blackwell sales are off the charts, and cloud GPUs are sold out. Compute demand keeps accelerating and compounding across training and inference — each growing exponentially. We’ve entered the virtuous cycle of AI. The AI ecosystem is scaling fast — with more new foundation model makers, more AI startups, across more industries, and in more countries. AI is going everywhere, doing everything, all at once.”

While we wait for $350, we can collect Nvidia’s dividend of a penny per share, which is payable Dec. 26 to shareholders of record as of Dec. 4.

Moving forward, Nvidia expects to generate $65 billion in revenue, which would be above expectations of $61.98 billion.

But What About a Bubble?

Don’t pay much attention to AI bubble talk.

Sure, over the last few weeks, Nvidia dipped from its all-time high of $212.19 to new recent lows below $180.

But most of that was because of AI bubble talk, which I don’t buy into. Neither does Goldman Sachs, which says the AI story is just getting started.

Even Mary Callahan Erdoes, CEO at JPMorgan Asset and Wealth Management, dispelled worries over valuation, saying that AI is presenting opportunities not fully appreciated or understood yet,” as noted by CNBC. “AI itself is not a bubble. That’s a crazy concept… We are on the precipice of a major, major revolution in a way that companies operate.”

The Artificial Intelligence Boom Is Not Slowing

Forecasts now place AI’s value between $1.7 trillion and $3.5 trillion by the early 2030s, with the most aggressive estimates topping $7 trillion by 2035. Fueling momentum, some of the largest tech companies are spending billions on AI capex.

- Google (GOOGL) raised its 2025 capex outlook to $91 billion to $93 billion.

- Microsoft (MSFT) is increasing spending 74% to $34.9 billion as of its first fiscal quarter.

- Meta (META) nearly doubled capex to $19.37 billion in Q3, far above expectations.

- Amazon (AMZN) projects $125 billion in 2025 capex, with more increases planned for 2026.

Even better, analysts at UBS now expects global AI capex to hit $571 billion in 2026, and potentially to $3 trillion by 2030.

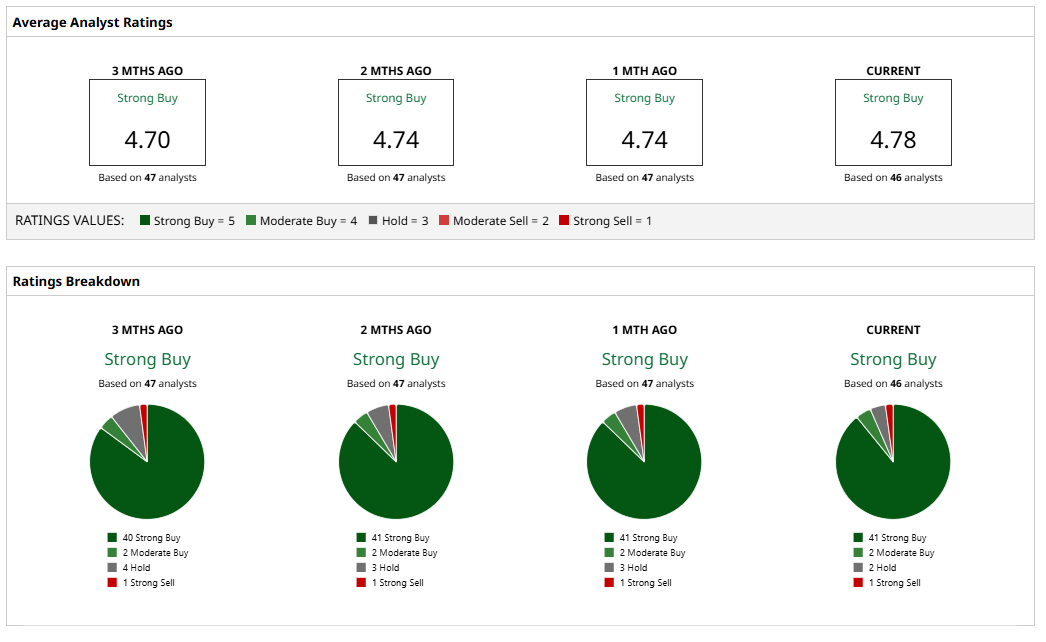

Again, with the AI boom showing very little signs of slowing, Nvidia will remain a standout buy opportunity. Despite talk of a bubble, much of Wall Street isn’t buying into it.

In short, go long Nvidia for the long term.

On the date of publication, Ian Cooper did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart

- Wall Street Sees a ‘Buying Opportunity’ in This Rare Earths Stock. Should You Snap Up Shares Now?

- Billionaire Gina Rinehart Is Now the Top Investor in MP Materials. Should You Follow the Money and Buy MP Stock Too?

- Can Nvidia Stock Test Wall Street’s Price Target of $350?

- A Fannie Mae IPO Is ‘Far From Ready.’ What Does That Mean for FNMA Stock Here?