According to a Bloomberg report, Australian mining magnate Gina Rinehart has made a significant bet on American rare earths. Rinehart became the top shareholder in MP Materials (MP) after boosting her stake to 8.4% in Q3 of 2025. The markets responded to the news by sending MP stock up about 9% yesterday, just to fall by almost the same amount during today's trading session.

The mining billionaire, whose net worth is $32.3 billion from iron ore operations in Western Australia, picked up another million shares through her investment firm, Hancock Prospecting.

This position now represents the crown jewel of her roughly $3 billion portfolio of American stocks and funds, worth nearly $1 billion at the end of September. The move puts Rinehart ahead of MP Materials founder and CEO James Litinsky, who holds a 7.9% stake. Her growing investment expands her footprint in the American defense supply chain, a notable shift given MP Materials operates the only rare earths mine in the United States.

The company recently landed a $400 million Pentagon investment and plans to build a new heavy rare-earth processing facility in California by mid-2026. For investors watching where billionaires park their money, Rinehart's substantial bet raises an important question: Does MP Materials deserve a spot in their own portfolios?

Should You Buy MP Materials Stock Right Now?

MP Materials delivered strong third-quarter results that showcase the company's transformation into America's rare earth powerhouse. In Q3, MP Materials posted record production of 721 metric tons of neodymium-praseodymium oxide, jumping 21% from the previous quarter and 51% year-over-year (YoY).

These results beat management's own guidance and mark steady progress toward the company's goal of reaching 6,000 tons annually by late 2026. MP Materials holds roughly $2 billion in cash against about $1 billion in debt, allowing it the financial flexibility to pursue growth initiatives.

The company is positioned to benefit from the Pentagon's price protection agreement, which began on Oct. 1. This deal guarantees MP Materials will receive at least $110 per kilogram for its rare-earth oxide, whether it sells it or stockpiles it.

The current market price for the commodity is around $61 per kilogram, providing MP Materials with a massive cushion that should push the company back to profitability starting in the fourth quarter.

Management laid out minimum annual earnings targets of roughly $650 million once operations fully ramp up, with about $400 million coming from the price floor on oxide production. The Pentagon has also committed to buying all output from MP's planned 10X magnet facility, guaranteeing $140 million in annual earnings from that operation alone. These contracted cash flows give the company unusual visibility and financial security for years ahead.

On the ground at Mountain Pass in California, work continues to advance the heavy rare-earth separation circuit, scheduled for commissioning in mid-2026. This facility will process about 3,000 metric tons of feedstock annually and produce over 200 metric tons of dysprosium and terbium. These heavy rare earths are critical for high-performance magnets. The company already has hundreds of tons of heavy rare earth concentrate stockpiled and ready for processing.

Down in Fort Worth at the Independence magnet facility, MP Materials remains on track to begin commercial magnet production for General Motors by year end. The company received its first $40 million prepayment from Apple during the quarter, with another similar payment expected in the fourth quarter as part of a $200 million total commitment to fund recycling capabilities and magnet production expansion.

Is MP Stock Overvalued?

CEO Jim Litinsky remains cautious about the broader rare earth sector and warned investors that most projects being promoted today won't work economically at any price.

He positioned MP Materials as having structural advantages through full vertical integration, sitting years and billions of dollars ahead of potential competitors. The company views demand exploding over the next decade, driven by physical AI, robotics, and electric vehicles.

Analysts tracking MP stock forecast revenue to increase from $204 million in 2024 to $1.23 billion in 2029. It is forecast to report an adjusted earnings per share of $2.64 in 2029, compared to a loss of $0.27 per share this year.

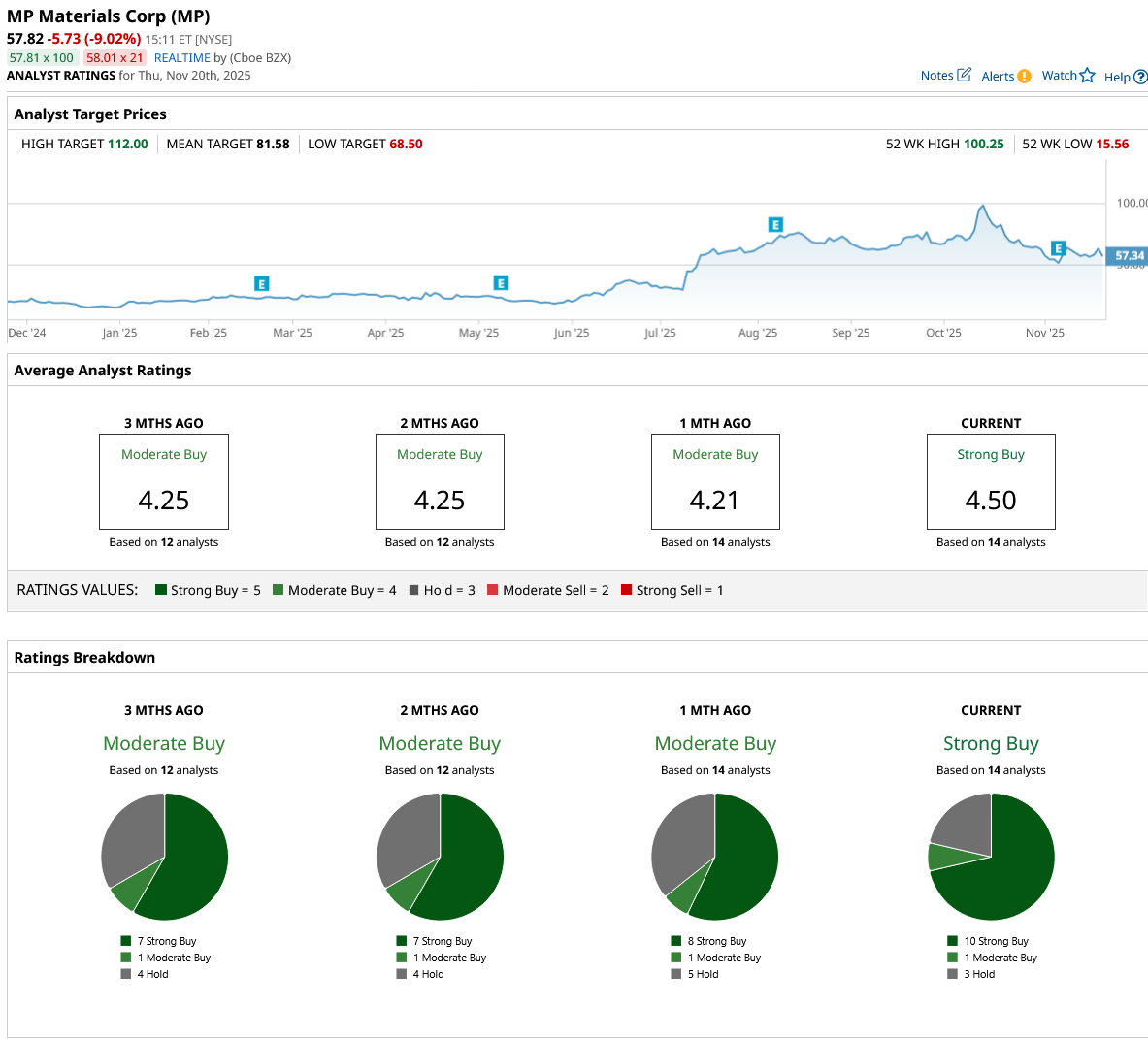

If MP Materials stock is priced at 35x forward earnings, which is reasonable, it could trade around $92 in late 2028, indicating an upside potential of almost 50% from current levels. Out of the 14 analysts covering MP stock, 10 recommend “Strong Buy,” one recommends “Moderate Buy,” and three recommend “Hold.” The average stock price target for the rare earth miner is $81.58, above its current price of $57.82.

On the date of publication, Aditya Raghunath did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart

- Wall Street Sees a ‘Buying Opportunity’ in This Rare Earths Stock. Should You Snap Up Shares Now?

- Billionaire Gina Rinehart Is Now the Top Investor in MP Materials. Should You Follow the Money and Buy MP Stock Too?

- Silver Stalled- Was the Recent Record High the Top?

- The Bull and Bear Cases for Gold, Silver Prices in November 2025