With a market cap of $37.5 billion, Prudential Financial, Inc. (PRU) is a major U.S.-based financial services company offering life insurance, retirement solutions, and global asset management through its PGIM division, which oversees about $1.5 trillion in assets. Its diversified model spans U.S. and international insurance, retirement products like annuities and pension risk transfers, and institutional asset management.

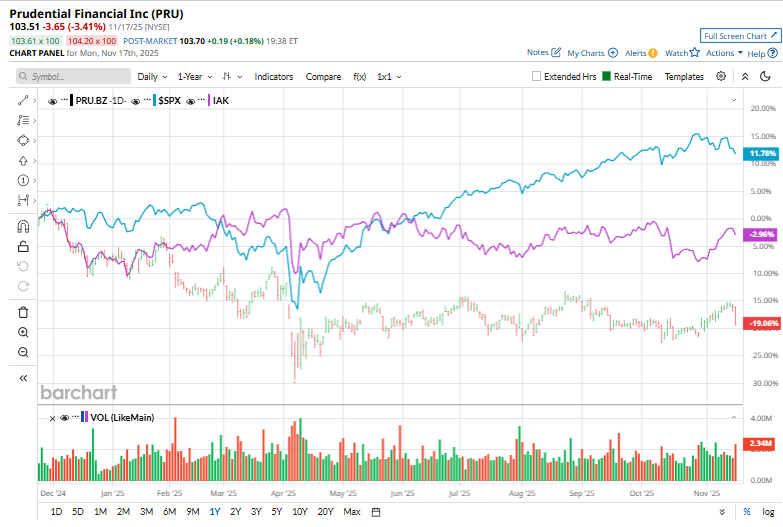

Shares of the insurance provider have trailed the broader market over the past year and in 2025. PRU stock has declined 18.8% over the past 52 weeks and 12.7% on a YTD basis. In comparison, the S&P 500 Index ($SPX) has returned 13.7% over the past year and 13.4% in 2025.

Narrowing the focus, PRU has also lagged behind the iShares U.S. Insurance ETF’s (IAK) marginal dip over the past 52 weeks and its 4.4% surge this year.

On Oct. 29, Prudential Financial released its third-quarter earnings, and its shares popped 1.9% after the company delivered a solid earnings beat and showcased strong operating momentum. Prudential posted after-tax adjusted operating income of $1.5 billion and $4.26 per share, up sharply from $1.2 billion and $3.33 per share a year earlier, while net income surged to $1.4 billion from $448 million.

The company also reported an increase in adjusted book value to $99.25 per share. Assets under management grew 3.5% year over year to $1.6 trillion, reflecting continued strength in PGIM. Prudential returned $731 million to shareholders through dividends and buybacks during the quarter.

For the current year ending in December, analysts expect PRU’s EPS to increase 12.8% year over year to $14.23. Moreover, the company has surpassed analysts’ consensus estimates in three of the past four quarters, while missing on one occasion.

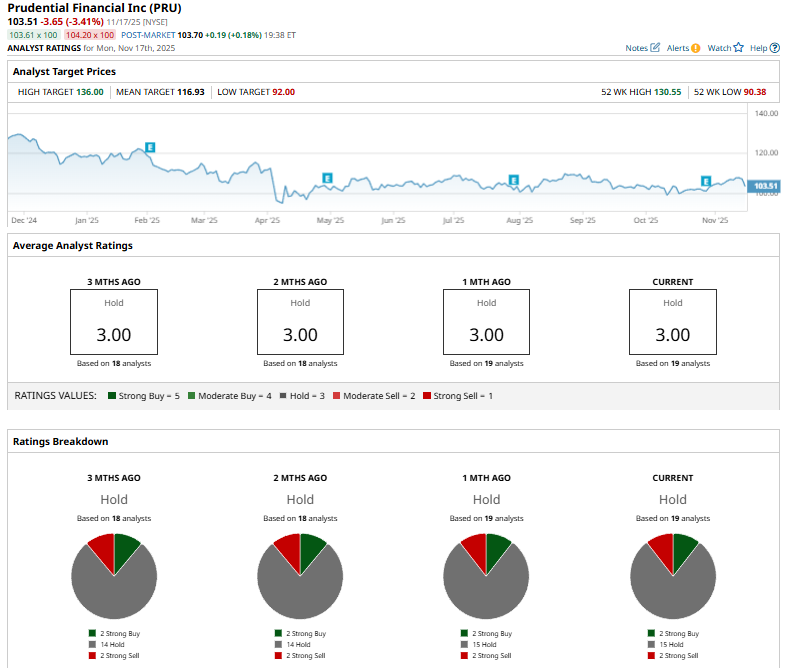

Among the 19 analysts covering the stock, the consensus rating is a “Hold.” That’s based on two “Strong Buy” ratings, 15 “Holds,” and two “Strong Sells.”

On Oct. 16, Piper Sandler analyst John Barnidge reiterated a “Hold” rating on Prudential Financial and set a $110 price target.

PRU’s mean price target of $116.93 indicates a premium of 13% from the current market prices. Its Street-high target of $136 suggests a robust 31.4% upside potential from current price levels.

On the date of publication, Kritika Sarmah did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart

- Warren Buffett Says to Embrace Stock Volatility Because ‘A Tolerance for Short-Term Swings Improves Our Long-Term Prospects’

- Dear Coinbase Stock Fans, Mark Your Calendars for December 17

- Bridgewater Is Betting Big on This 1 Chip Stock (Not Nvidia). Should You Buy Shares Here?

- S&P Futures Slip on Souring Risk Sentiment