Orrville, Ohio-based The J. M. Smucker Company (SJM) manufactures and markets branded food and beverage products. Valued at $11.6 billion by market cap, the company's principal products include peanut butter, shortening and oils, fruit spreads, canned milk, baking mixes and ready-to-spread frostings, flour and baking ingredients, juices and beverages, and more.

Shares of this leading consumer packaged goods company have underperformed the broader market over the past year. SJM has declined marginally over this time frame, while the broader S&P 500 Index ($SPX) has rallied nearly 13.7%. In 2025, SJM’s stock fell 3.3%, compared to the SPX’s 13.4% rise on a YTD basis.

However, SJM’s outperformance is apparent compared to the First Trust Nasdaq Food & Beverage ETF (FTXG). The exchange-traded fund has declined about 10.8% over the past year. Moreover, SJM’s dip on a YTD basis outshines the ETF’s 8.4% losses over the same time frame.

On Aug. 27, SJM shares closed down more than 4% after reporting its Q1 results. Its adjusted EPS of $1.90 missed Wall Street expectations of $1.95. The company’s revenue was $2.11 billion, missing Wall Street forecasts of $2.13 billion. SJM expects full-year adjusted EPS in the range of $8.50 to $9.50.

For the current fiscal year, ending in April 2026, analysts expect SJM’s EPS to fall 99% to $9.13 on a diluted basis. The company’s earnings surprise history is mixed. It beat the consensus estimate in three of the last four quarters while missing the forecast on another occasion.

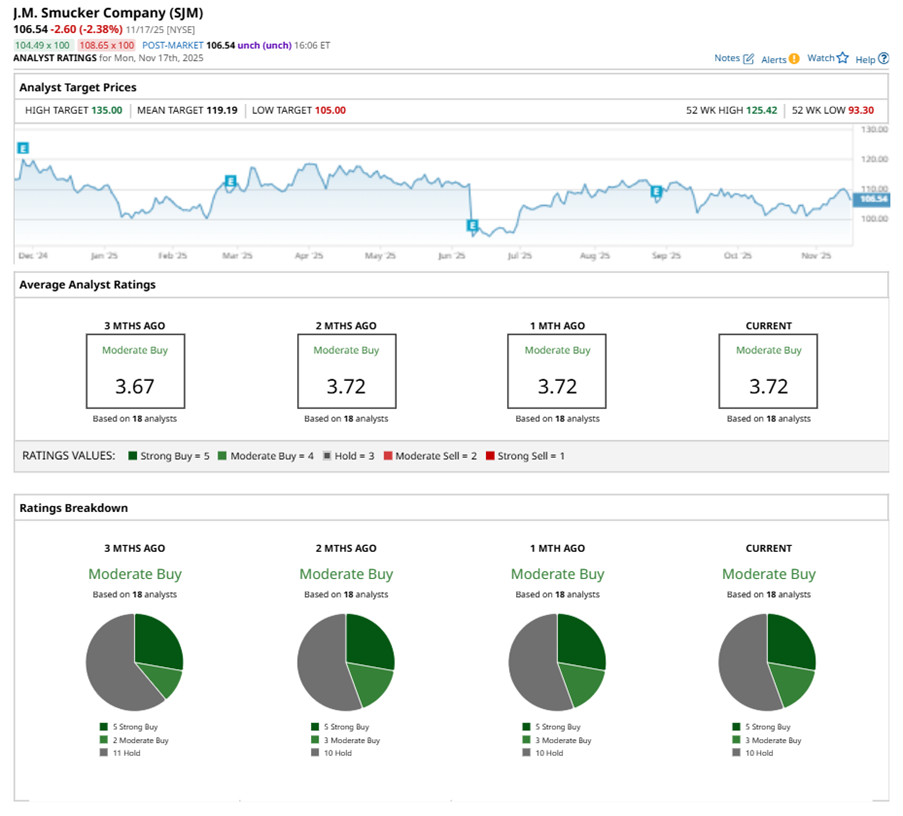

Among the 18 analysts covering SJM stock, the consensus is a “Moderate Buy.” That’s based on five “Strong Buy” ratings, three “Moderate Buys,” and 10 “Holds.”

This configuration is more bullish than three months ago, with two analysts suggesting a “Strong Buy.”

On Nov. 14, Bank of America Corporation (BAC) analyst Peter Galbo maintained a “Hold” rating on SJM and set a price target of $118, implying a potential upside of 10.8% from current levels.

The mean price target of $119.19 represents an 11.9% premium to SJM’s current price levels. The Street-high price target of $135 suggests a notable upside potential of 26.7%.

On the date of publication, Neha Panjwani did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart

- S&P Futures Slip on Souring Risk Sentiment

- Think AI Stocks Are Overvalued? Invest in These Data Center Power Trades for the Next Growth Phase.

- This High-Yield Dividend Stock Is Beaten Down, But Wall Street Still Loves It

- Unusual Options Activity Shows 71,000 Calls Hit the Tape for Applied Digital Stock – How You Should Play APLD Here