AI stocks have been pulling back in recent trading sessions, but certain analysts believe that the dominant ones are set to keep rallying. Last Tuesday, top Jefferies analyst Blayne Curtis increased his price target on Nvidia (NVDA) from $220 to $240, keeping his "Buy" rating.

He cited that Nvidia revealed $500 billion in orders for 2025 to 2026 across its Blackwell and Rubin chips during the GTC 2025 event. He sees Nvidia continuing to be a "dominant" player in the industry. It offers “all the building blocks, including GPU, CPU, NIC, Scale Up Switch, Scale Out Switch, and now CPX.”

Jefferies Sees a Long Runway of Growth for Nvidia

The analyst believes this huge order backlog will lead to revenue growth staying well above hypergrowth levels. For the aforementioned two products, Nvidia could rake in $464 billion in revenue in calendar 2025 and 2026 alone.

Jefferies' revenue estimates calendar 2026 revenue to be $293 billion and 2027 revenue to be $384 billion. They expect EPS to be in the range of $9 to $10 in 2027.

Revenue for fiscal year 2026 (ends in January 2026) is expected to be $207.3 billion by the broader analyst community. Fiscal year 2027 is expected to bring in $287.2 billion at the midpoint, with one analyst having a record high revenue estimate of $412.53 billion. Jefferies' estimate is slightly higher than the midpoint.

They do deviate when it comes to EPS. Fiscal year 2028 EPS is expected to be $8.73, so Jefferies' EPS target of up to $10 sits closer to the highest analyst estimate of ~$11.

How Long Can NVDA Stock Keep Rallying?

Unlike most smaller AI-related stocks, Nvidia's rally has been quite organic. Investors are not bidding up the stock without substance. Instead, the stock has been rising in line with an explosive growth in revenue and earnings. You're still paying 29 times forward earnings for the calendar year 2026. This is nothing but cheap, as long as Nvidia meets these expectations.

Accordingly, NVDA stock can keep delivering monster returns as far as the eye can see. This would require hyperscalers to keep ordering more and more GPUs and remain fully committed to the AI build out.

Nvidia is a large company, so a slowdown in growth is inevitable, but analysts see EPS and revenue growth at 25% to 30% annually, even three years out.

Should You Buy NVDA Stock Now?

Estimates are a good starting point for speculation about where a company can go. It's still a good idea to buy NVDA stock today, but the stock may not gain as fast in the future.

This is primarily because hyperscalers may have to slow down if they deplete their cash reserves too fast. For example, Meta Platforms (META) had almost $29 billion in net cash at the end of 2024. In Q3 2025, Meta had ~$6.5 billion more in debt than cash.

Regardless, other hyperscalers still have more cash left, and this can power momentum for one to two more years. NVDA stock alone has an 8% weight in the S&P 500 ($SPX) today, so it's still a good idea to buy and hold the stock.

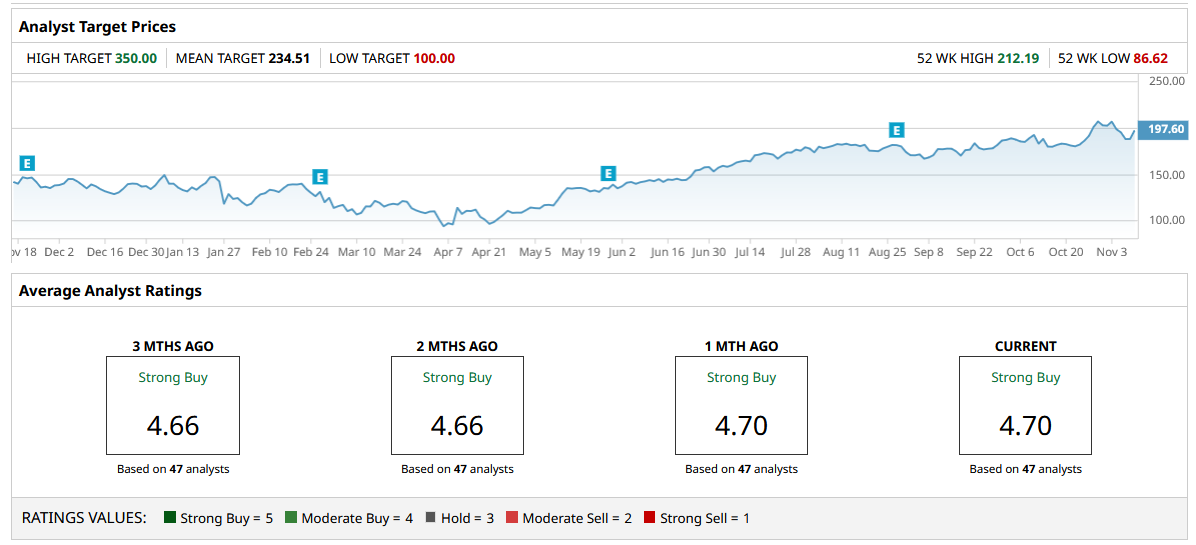

The average price target is $234.51, with the highest at $350.

The market remains overwhelmingly bullish, with the vast majority of the 47 analysts covering NVDA giving it a “Strong Buy.”

On the date of publication, Omor Ibne Ehsan did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart

- Plug Power Just Got a $275 Million Boost. Should You Buy PLUG Stock Here?

- Shareholders Just Approved a $1 Trillion Pay Package for Elon Musk. What Does That Mean for Tesla Stock in 2026?

- Options Traders Bet Beyond Meat Stock Could Move 30% When It Posts Delayed Q3 Earnings This Week

- SoundHound Is Gearing Up for the ‘Next Stage of AI Growth.’ Should You Buy SOUN Stock First?