With a market cap of $37.6 billion, Keurig Dr Pepper Inc. (KDP) is a leading beverage and brewing systems company operating in the United States and internationally. The company produces and distributes a wide range of popular brands, including Dr Pepper, Green Mountain Coffee Roasters, Snapple, and Keurig across its U.S. Refreshment Beverages, U.S. Coffee, and International segments.

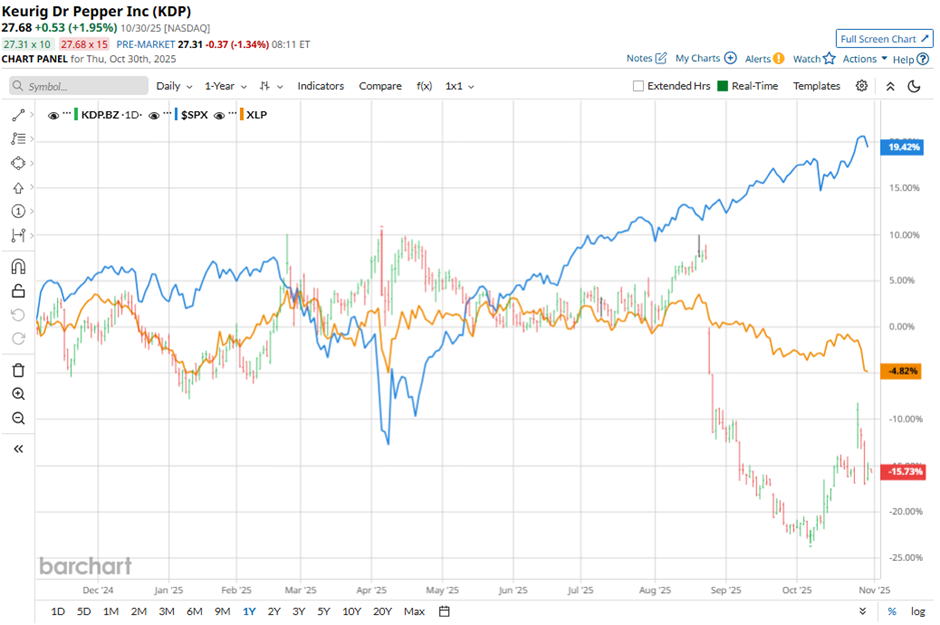

Shares of the Burlington, Massachusetts-based company have underperformed the broader market over the past 52 weeks. KDP stock has fallen 16.9% over this time frame, while the broader S&P 500 Index ($SPX) has gained 17.4%. Moreover, shares of the company are down 14.6% on a YTD basis, compared to SPX’s nearly 16% increase.

Narrowing the focus, shares of Keurig Dr Pepper have also lagged behind the Consumer Staples Select Sector SPDR Fund’s (XLP) over 5% decline over the past 52 weeks and 3% drop on a YTD basis.

Shares of Keurig Dr Pepper climbed 7.6% on Oct. 27 after the company reported strong Q3 2025 results, with net sales rising 10.7% to $4.31 billion and adjusted EPS increasing 5.9% to $0.54. Growth was driven by robust performance in U.S. Refreshment Beverages, where sales surged 14.4%, aided by the GHOST acquisition contributing 7.2 percentage points to volume growth. Investor confidence was further boosted as KDP raised its full-year constant currency net sales growth outlook to a high-single-digit range.

For the fiscal year ending in December 2025, analysts expect KDP’s adjusted EPS to grow 6.8% year-over-year to $2.05. The company’s earnings surprise history is strong. It beat or met the consensus estimates in the last four quarters.

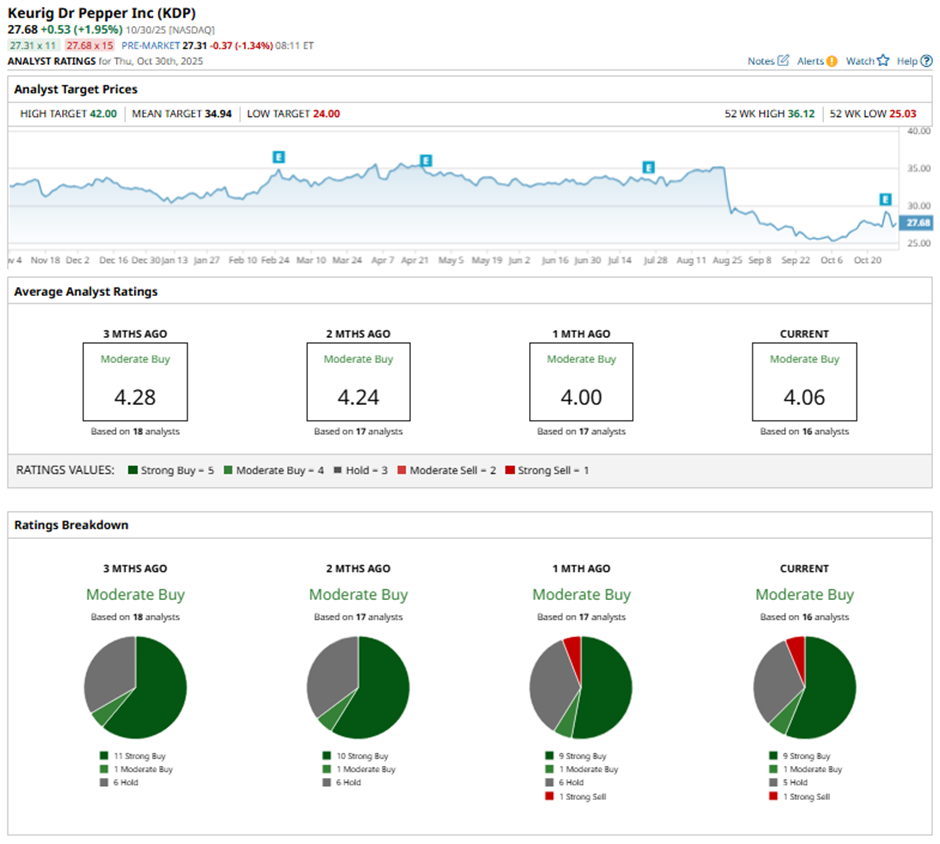

Among the 16 analysts covering the stock, the consensus rating is a “Strong Buy.” That’s based on nine “Strong Buy” ratings, one “Moderate Buy,” five “Holds,” and one “Strong Sell.”

This configuration is less bullish than it was three months ago, when KDP had 11 “Strong Buys” in total.

On Oct. 29, Jefferies lowered its price target on Keurig Dr Pepper to $39 but maintained a “Buy” rating.

The mean price target of $34.94 represents a 26.2% premium to KDP’s current price levels. The Street-high price target of $42 suggests a 51.7% potential upside.

On the date of publication, Sohini Mondal did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart