With a market cap of $149 billion, Boston Scientific Corporation (BSX) develops, manufactures, and markets innovative medical devices used in various interventional medical specialties worldwide. It operates through two main segments: MedSurg and Cardiovascular, offering advanced solutions for diagnosing and treating complex conditions across gastrointestinal, urological, neurological, and cardiovascular care.

Shares of the Marlborough, Massachusetts-based company have outperformed the broader market over the past 52 weeks. BSX stock has increased 19.9% over this time frame, while the broader S&P 500 Index ($SPX) has gained over 18%. However, shares of the company have risen 12.7% on a YTD basis, lagging behind SPX's 16.7% YTD return.

Looking closer, the medical device manufacturer stock has also outpaced the Health Care Select Sector SPDR Fund's (XLV) 3.3% drop over the past 52 weeks.

Shares of Boston Scientific rose nearly 4% on Oct. 22 after the company reported better-than-expected Q3 2025 adjusted EPS of $0.75 and revenue of $5.07 billion. The company also raised its 2025 adjusted EPS forecast to $3.02 - $3.04 and guided Q4 adjusted EPS of $0.77 - $0.79, above the consensus. Investor optimism was further fueled by strong demand for its heart devices, including a 23.1% jump in electrophysiology sales driven by the Watchman and Farapulse systems, along with improving operating margins despite tariff headwinds.

For the fiscal year ending in December 2025, analysts expect BSX’s adjusted EPS to grow 20.7% year-over-year to $3.03. The company’s earnings surprise history is promising. It beat the consensus estimates in the last four quarters.

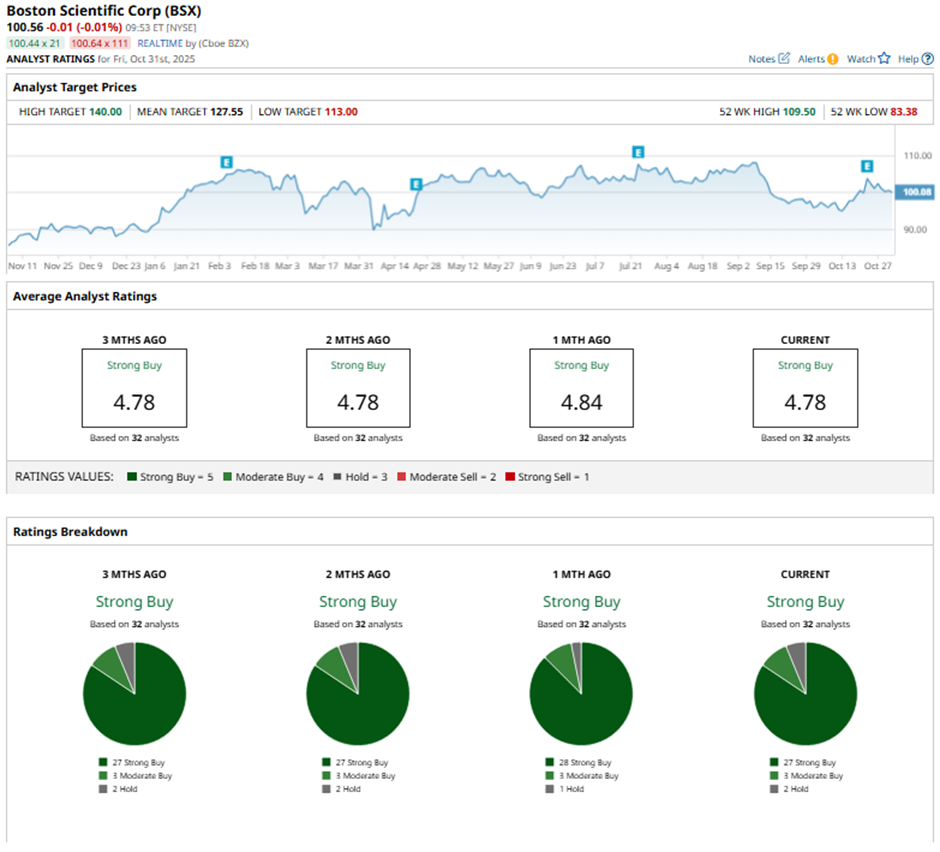

Among the 32 analysts covering the stock, the consensus rating is a “Strong Buy.” That’s based on 27 “Strong Buy” ratings, three “Moderate Buys,” and two “Holds.”

On Oct. 23, UBS raised its price target on Boston Scientific to $140 and reaffirmed its “Buy” rating.

The mean price target of $127.55 represents a 26.8% premium to BSX’s current price levels. The Street-high price target of $140 suggests a 39.2% potential upside.

On the date of publication, Sohini Mondal did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart