LONDON, UNITED KINGDOM / ACCESS Newswire / June 28, 2025 / If you're looking for a crypto platform that does more than just let you buy Bitcoin, Uphold might catch your eye. It supports not only hundreds of cryptocurrencies but also precious metals, U.S. stocks, and even carbon credits, all under one account. But does this "all-in-one" approach work in practice?

We've been testing Uphold for over three months, using it for both personal investing and cross-asset swaps. What we found was a platform that's refreshingly simple but not built for everyone.

In this Uphold review, we'll break down what Uphold gets right, where it lags, and whether it's the right fit for your crypto goals in 2025.

Uphold Review: Our Final Take

Uphold stands out for its flexibility and ease of use. In our testing, it handled cross-asset swaps, like crypto to gold or USD, faster than most platforms. It's ideal for long-term holders or anyone managing a diversified portfolio. While fees are on the higher side, you're trading that for simplicity, strong security, and real-time proof of reserves.

CREATE YOUR FREE UPHOLD ACCOUNT TODAY

Uphold at a Glance

Here's a quick overview of what you get with Uphold:

Feature |

Details |

Founded |

2015 |

Available Assets |

300+ cryptocurrencies, 27 fiat currencies, 4 precious metals, U.S. equities |

Trading Fees |

1.4%-2.95% spread-based |

Deposit Fees |

Free (bank, crypto), 3.99% (card) |

Withdrawal Fees |

Network fees for crypto; varies for fiat |

Staking Options |

19+ cryptos (up to 17.6% APY); not available in U.S., U.K., EU |

USD Interest Account |

Up to 5% APY through FDIC-backed partner bank |

Mobile App Rating |

4.6★ (iOS), 4.3★ (Android) |

Wallet Options |

Custodial, Vault (delayed withdrawal), UpHODL (non-custodial Web3) |

Regulation |

Registered with FinCEN (U.S.), FCA (U.K.), CSSF (EU) |

Best For |

Beginners, long-term holders, multi-asset investors |

Not Ideal For |

Day traders, users needing advanced charts or live support |

What Is Uphold?

Uphold is a multi-asset trading platform that lets you buy, sell, and swap over 300 cryptocurrencies, metals, and fiat currencies, all in one place.

It launched in 2015 and has since grown into a popular choice for everyday investors who want simplicity over complexity.

You can buy Bitcoin, convert it into gold, then trade it for U.S. dollars, all without moving funds between platforms. That's Uphold's main draw: flexibility and convenience in a single account.

What stood out during our testing was how easy it is to swap assets. No need to use multiple wallets or exchanges. Everything happens inside one interface, whether you're investing casually or setting up recurring crypto buys.

Just keep in mind that the simplicity comes at a cost, especially in terms of fees and limited advanced tools.

Pros and Cons of Using Uphold

We used Uphold across desktop and mobile to test its ease of use, asset range, and transaction speed. Here's where it shines, and where it falls short.

Pros of Uphold

Extremely beginner-friendly interface: From signing up to your first trade, the entire experience feels clean and intuitive. No learning curve, no hidden menus.

Wide variety of assets beyond crypto: You're not limited to Bitcoin and Ethereum. Uphold supports metals like gold and silver, over 25 fiat currencies, and even U.S. equities. Perfect if you want to diversify.

One-click anything-to-anything swaps: Want to convert Ethereum to gold or XRP to USD? It's as easy as a single click. This cross-asset trading is one of Uphold's standout features.

Transparent reserves and proof of solvency: Every asset on Uphold is backed 1:1. You can verify this in real-time with their Proof of Reserves dashboard.

Multiple wallet options for different needs: You get a standard custodial wallet, a Vault with delayed withdrawals for extra safety, and UpHODL if you prefer Web3-style non-custodial access.

Cons of Uphold

Higher-than-average trading fees: The spread-based fees (up to 2.95%) are noticeably higher than what you'll find on platforms like Kraken or Binance.

Limited trading tools: No order book, no advanced charts, and no margin or futures trading. Active traders will feel restricted.

Support can feel slow: You're limited to email support and help articles. In our tests, responses took 24-48 hours on average.

Uphold Key Features at a Glance

Uphold tries to be more than just a crypto exchange, and for the most part, it succeeds. Here's a breakdown of the key features that stood out when we tested it.

300+ cryptocurrencies, including Bitcoin, Ethereum, XRP, Solana, Dogecoin

27 fiat currencies like USD, EUR, GBP, MXN

Trade between any asset pair instantly (crypto to fiat, crypto to gold, etc.)

USD account earning up to 5% APY

Real-time Proof of Reserves dashboard

Staking options with up to 17.6% APY (not available in the U.S.)

Recurring buy (DCA) and auto-swap tools

3 wallet types for different user preferences

Mobile and desktop sync seamlessly

START TRADING CRYPTO, METALS, AND FIAT IN ONE PLACE

Uphold Fees Explained

Uphold doesn't charge standard trading fees like some exchanges. Instead, it applies a spread, a markup built into the price. Here's what to expect.

Trading Fees (Spread-Based)

Uphold charges a spread ranging from 1.4% to 2.95%, depending on the asset and market volatility. For example, during our ETH-to-USD trade, the effective fee was about 2.2%. You won't see a line-item fee. it's baked into the rate.

Spreads

Spreads are typically higher on low-liquidity tokens and during high market volatility. Popular coins like BTC and ETH have lower spreads, while meme coins or new listings can have spreads above 3%.

Deposit Fees

Bank transfer (ACH, SEPA): Free

Crypto deposits: Free

Debit/credit card: 3.99% processing fee

We tested deposits via ACH and it took around 1-2 business days to settle with zero fee. Card payments were instant but costly.

Withdrawal Fees

Crypto withdrawals: Network fee only (no extra markup)

Fiat withdrawals (bank): Varies by region

During testing, our BTC withdrawal reflected within 20 minutes with only the blockchain fee applied.

Is Uphold Safe and Legit?

Yes, Uphold is a legitimate and regulated crypto platform with strong transparency features and security protocols in place.

It is registered with FinCEN in the United States, authorized by the FCA in the United Kingdom, and operates under strict rules in the EU (via CSSF). You can view real-time proof of reserves at any time, showing that every dollar, coin, or ounce of gold is fully backed.

In our testing, Uphold also passed basic security checks. It supports 2FA, biometric logins, device authorization and has never suffered a major hack.

While crypto balances are not insured, fiat funds in the USD Interest Account are held at FDIC-insured partner banks.

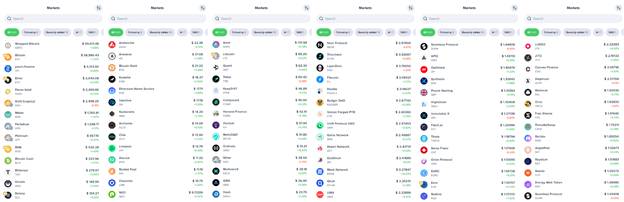

What Cryptocurrencies Are Available on Uphold?

Uphold offers one of the most extensive crypto selections we've seen on a beginner-friendly exchange, with over 300 cryptocurrencies as of 2025.

That includes all the major names like Bitcoin (BTC), Ethereum (ETH), Solana (SOL), and XRP, plus a growing list of altcoins, stablecoins, and even newer tokens tied to DeFi and Web3 ecosystems. You can also trade meme coins like Dogecoin (DOGE) and Shiba Inu (SHIB), which are surprisingly popular on the platform.

Here are just a few categories we explored while testing:

Top cryptos: BTC, ETH, ADA, XRP, LTC, SOL, DOT

Stablecoins: USDC, USDT, DAI, EURC

Layer 2s & DeFi: MATIC, AVAX, AAVE, UNI

Web3 & NFTs: FLOW, SAND, CHZ, GALA

Emerging & meme coins: PEPE, FLOKI, BONK, DOGE

We liked that Uphold made it easy to sort by popularity, volume, or staking eligibility, especially when managing a diversified portfolio. Most tokens can be swapped instantly using the anything-to-anything feature, which we found faster than most traditional order-based systems.

EXPLORE UPHOLD'S ASSET OPTIONS NOW

How the Wallet System Works

Uphold offers three distinct wallet options, which is a standout feature compared to many other exchanges that only offer custodial wallets. Here's what we learned from testing each:

Standard Wallet (Custodial): This is the default wallet when you create an account. Uphold holds your private keys, and you simply log in with your account credentials. It's perfect for everyday use and beginners who don't want to manage their own security.

Vault Wallet: This option delays withdrawals by up to 48 hours, giving you time to cancel if your account is ever compromised. We set it up with Bitcoin and found the extra step adds peace of mind, especially if you're holding large amounts.

UpHODL Wallet (Non-Custodial): This is Uphold's Web3 wallet that puts you in full control of your private keys. It works like MetaMask, supports dApps, and gives you access to the broader DeFi ecosystem. It's still in beta, but we found it responsive and well-designed.

Each wallet type is designed for different levels of user control. We personally used the Vault for long-term holdings and the standard wallet for day-to-day trades.

Mobile App Experience

We tested Uphold's app on both iOS and Android, and it's one of the most polished apps we've used for crypto. It mirrors the desktop experience but simplifies a few key flows like asset swaps, price alerts, and recurring buys.

The dashboard makes it easy to track all your holdings, crypto, metals, and fiat in one place. Swaps are quick, and the one-click trading works just as smoothly on mobile as on desktop. We especially liked the Face ID integration and clean UI.

App Ratings (as of June 2025):

iOS App Store: ★4.6 (out of 5)

Google Play: ★4.3 (out of 5)

We did run into one small issue: the app occasionally required us to reauthenticate when switching networks, but nothing deal-breaking. Overall, it's reliable and beginner-friendly, even for multi-asset users.

Uphold Staking and Interest

Uphold offers two ways to earn passive income: crypto staking and USD interest accounts. We tested both features and here's what we found.

Crypto Staking

Uphold supports staking for 19+ assets, including Ethereum (ETH), Polkadot (DOT), Solana (SOL), and Tezos (XTZ).

Yields vary, but go up to 17.6% APY for certain tokens.

Minimum staking amounts apply (usually $1 to $10 depending on the asset).

One major catch: staking is not available in the U.S., U.K., or EU due to regulatory restrictions. If you're outside these regions, it's a simple toggle from your wallet. We tested DOT staking from a supported region and saw daily reward updates directly in the dashboard.

USD Interest Account

If you're not into staking, Uphold lets you earn up to 5% APY on USD held in your account:

Balances under $1,000 earn 2% APY

Balances over $1,000 earn 5% APY

Funds are held with FDIC-insured partner banks, making this a great option for low-risk earning

Interest is calculated daily and paid monthly. We used this as a digital savings account, and the return felt fair given the zero lock-in period.

EARN UP TO 5% INTEREST ON YOUR USD BALANCE

Uphold Customer Support Review

Uphold's customer support is decent for casual users but may feel limited if you run into urgent issues. During our testing, the only way to contact their team was via email or by submitting a support ticket through their Help Center. There is no live chat or phone support, which can be frustrating if you need real-time assistance.

That said, the responses we received were polite and relatively prompt. For general questions, we usually heard back within 24-48 hours.

The Help Center itself is well-organized, with clear guides on deposits, withdrawals, and account security. Still, if you're someone who prefers immediate, human support, Uphold might fall short.

Who Should Use Uphold?

Uphold is a great choice for people who want simplicity, flexibility, and access to more than just crypto. We found it especially helpful for long-term holders and anyone looking to manage multiple asset types, like crypto, gold, and fiat, without juggling multiple platforms.

You'll probably like Uphold if you:

Want a beginner-friendly way to buy and swap crypto

Prefer an all-in-one platform for crypto, metals, and fiat

Like seeing proof of reserves and clear backing for your assets

Are interested in earning passive income through staking or interest

Need a clean mobile app to manage your investments on the go

Who Should Look Elsewhere?

While Uphold checks many boxes, it's not ideal for advanced traders or those looking for the lowest fees. If you rely on detailed charting tools, order books, or need instant customer support, other exchanges might suit you better.

You may want to consider alternatives if you:

Actively trade and want advanced tools like margin or futures

Need 24/7 live support or chat-based assistance

Are fee-sensitive and want the lowest trading costs

Want staking options but live in a restricted region like the U.S. or U.K.

Prefer using platforms with more liquidity and tighter spreads

Uphold Alternatives: Uphold vs Coinbase vs Robinhood

If you're comparing Uphold with other beginner-friendly platforms, here's how it stacks up:

Feature |

Uphold |

Coinbase |

Robinhood |

Assets Supported |

300+ crypto, 27 fiat, metals, stocks |

250+ cryptocurrencies |

18+ cryptos, U.S. stocks |

Fees |

1.4%-2.95% spreads |

Up to 4.5% with hidden fees |

$0 trading, but hidden in spreads |

Wallet Options |

Custodial, Vault, Web3 (UpHODL) |

Custodial only |

Custodial only |

User Experience |

Simple and versatile |

Beginner-friendly |

Extremely simplified, but limited |

Staking |

Yes (not in U.S./U.K./EU) |

Yes (U.S. only, limited tokens) |

No |

Interest on USD |

Yes, up to 5% |

No |

No |

Customer Support |

Email only |

Limited live chat and ticket system |

Live chat available |

Best For |

Diversified investing, long-term users |

U.S. users new to crypto |

Stock traders dabbling in crypto |

Final Verdict: Is Uphold Worth Using in 2025?

If you're looking for a simple, all-in-one platform to manage crypto, fiat, and even precious metals, Uphold is a strong choice in 2025. It's easy to use, offers a wide range of assets, and adds trust with real-time proof of reserves.

While the fees can be higher than some competitors and support could be better, the overall experience feels smooth, especially for beginners and long-term investors.

In our own testing, we found Uphold reliable, transparent, and refreshingly easy to navigate. It's not perfect for advanced traders or those chasing the lowest spreads, but for everyday investing and portfolio building, it's one of the more user-friendly options out there.

If you're someone who values simplicity, passive income options, and cross-asset flexibility, Uphold is definitely worth considering.

Frequently Asked Questions

Is Uphold a safe place to store crypto?

Yes. Uphold uses industry-standard security features like 2FA, device authorization, and biometric login. Assets are backed 1:1, and the platform publishes real-time proof of reserves.

How do Uphold's fees compare to other exchanges?

Uphold uses spread-based pricing, usually between 1.4% and 2.95%. It's higher than low-cost platforms like Binance, but competitive with Coinbase for most trades.

Can I stake crypto on Uphold?

Yes, Uphold offers staking on 19+ coins with up to 17.6% APY. However, staking is not available in the U.S., U.K., or EU due to local regulations.

Is Uphold legit or a scam?

Uphold is a legitimate, regulated financial platform. It's registered with FinCEN in the U.S., the FCA in the U.K., and other regulatory bodies across Europe.

Does Uphold work in my country?

Uphold is available in most countries, including the U.S., U.K., Canada, and the EU. Some features, like staking or card purchases, may be restricted depending on local laws.

Media Contact:

Media Team

contact@uphold.com

SOURCE: Uphold

View the original press release on ACCESS Newswire