To gain a thorough understanding of Shenzhen's Huaqiangbei, the topic of "Huaqiangbei shanzhai phones" is inevitably intertwined. At the zenith in 2007, Huaqiangbei shipped approximately 150 million shanzhai phones, accounting for one-sixth of the global mobile phone production volume, underscoring their significant impact on the industry and society.

The rise and fall of shanzhai phones were swift; they not only created stories of dozens of billionaires emerging from mere "one-meter counters" in Huaqiangbei but also witnessed tragedies like that of Chen Jinling, the so-called "Prince of Shanzhai Phones," who went bankrupt, suffered a mental breakdown, and ended up on the streets.

The development of "shanzhai phones" fostered a maker culture in Huaqiangbei, propelling Shenzhen to become the "Hardware Silicon Valley" and a "Startup Paradise," while also nurturing renowned domestic mobile phone companies such as Meizu, G5, Longcheer, and Transsion.

However, this development ran counter to the government's then-advocated trend of "intellectual property protection" for patents and brands. At the crossroads where market development, technological innovation, government regulation, economic growth, business ethics, and legal construction were on the verge of collision at any given moment, the situation became an intricate and confusing tangle, too complex to clarify distinctly. Consequently, domestic official media and economic experts remained conspicuously reticent about the entire shanzhai phone phenomenon.

In an effort to meticulously document and, to the fullest extent possible, reconstruct the authentic history of Huaqiangbei, and to provide a systematic, all-encompassing, and profound exploration of the origins and developments of "Huaqiangbei Shanzhai Phones," this article draws upon insights from authoritative media sources and professional institutions such as Harvard Business Review. It also incorporates the firsthand observations, experiences, and records of Mr. Song Shiqiang from Kinghelm (https://www.kinghelm.net/) and Slkor (https://www.slkoric.com/), who has been deeply involved in Huaqiangbei for over a decade. By delving into the underlying principles of socioeconomics, we aim to lift the veil of mystery surrounding this industry and offer meaningful insights for societal advancement.

I.The Etymological Research on "Shanzhai"

The term "Shanzhai" is derived from its Chinese counterpart. In English, it is often written as "Shanzhai" or "ShanZai", with some also translating it as "mountain stronghold" or "mountain fortress".

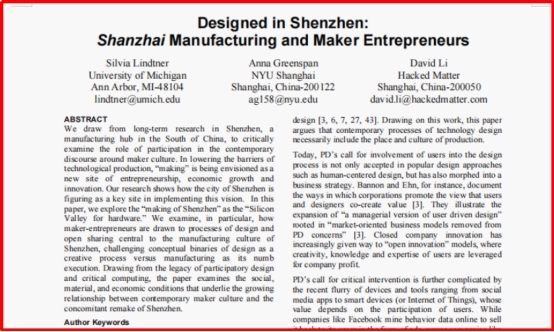

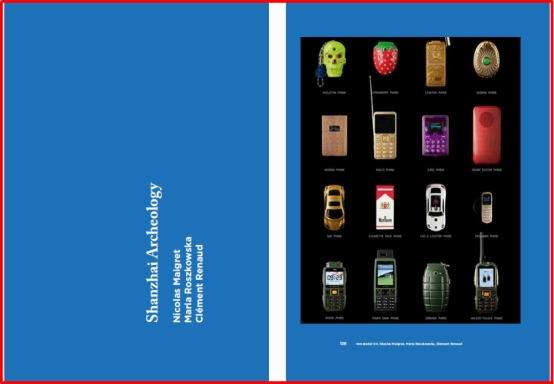

Many economists, both at home and abroad, have adopted the term "Shanzhai" to describe products and economic phenomena that exist outside the normal economic order regulated by the government. Indeed, in well-known publications and research papers—such as Designed in Shenzhen: Shanzhai Manufacturing and Maker Entrepreneurs (by Silvia Lindtner), Shanzhai Archeology (by Nicolas Maigret, featured in Harvard Business Review), and Shanzai! MediaTek and the White Box Handset Market Case Study Solution Analysis (by Willy Shih)—"Shanzhai" is portrayed as an informal economic and social phenomenon that operates beyond the full scope of governmental regulation, a realm I term as the "deep gray zone".

This concept is also echoed in the book Huaqiangbei Rubik's Cube (authored by Qian Hanjiang and Qian Feiming). According to merchants in Huaqiangbei quoted in the book, the products traded there predominantly originate from Shenzhen and its neighboring cities in the Pearl River Delta. To steer clear of potential issues, manufacturers opted not to label products as "Made in Shenzhen" but instead used "Made in SZ." (Note: Since there is no official English version of this book, the translation is provided by the author of this article.)

Buyers soon associated "SZ" with the pinyin abbreviation for "Shanzhai," leading to mobile phones from this region being dubbed "Shanzhai phones."

Later, Mr. Jin Xinyi, a local Shenzhen economist, encountered similar anecdotes during his research on Huaqiangbei. His writings on "Shanzhai phones" further popularized the term across China.

The contents of “Designed in Shenzhen: Shanzhai Manufacturing and Maker Entrepreneurs

I, Song Shiqiang from Huaqiangbei, also discovered through my research that the term "Shanzhai" originated in Hong Kong during the 1960s. At that time, it referred to small, family-run workshops established on hillsides. These workshops, mostly rudimentary wooden shacks, produced low-cost, inferior imitations of renowned overseas brands such as Gucci, Nike, and Louis Vuitton, and were humorously dubbed "Shanzhai factories."

Huaqiangbei inherently carried the essence of "Shanzhai." In its early days, the old SEG Electronics Market was bustling with individuals who amassed fortunes by assembling computers or trading in second-hand imported computers. Additionally, a plethora of "Shanzhai" computer peripherals were sold, and business thrived. Gradually, Huaqiangbei evolved into a major hub for electronic hardware distribution.

It's said that after graduating from Shenzhen University in 1993, Pony Ma (later known as the founder of Tencent) began his entrepreneurial journey by assembling computers at a humble counter in Huaqiangbei.

Later, as Hong Kong’s electronics manufacturing industry migrated to Shenzhen, the “Shanzhai DNA” took root across the Pearl River Delta. With the mobile phone supply chain maturing and Huaqiangbei emerging as a global electronics epicenter, the Shanzhai phone industry erupted like wildfire—fueled by both opportunity and audacity. To borrow a poetic Chinese phrase, it was as if “the golden wind of autumn meets the dew of jade, surpassing all earthly encounters.”

In Huaqiangbei, the latest Nokia and MOTO Phone models could be replicated within days. During the heyday of Shanzhai phones, a new model would debut every three days, featuring innovative designs and functions, along with a full range of peripheral products and after-sales services.

Based on my observations from my time in Huaqiangbei, such "wild growth" phenomena were not unique to the area. Similar patterns emerged in Shenzhen's Nanshan District at the Nanyou Clothing Market, Luohu District's Shuibei Gold & Jewelry Market, and even the early computer-assembly ecosystem that thrived around SEG Plaza in Futian's Huaqiangbei. The same story repeated itself in Zhejiang's Yiwu Small Commodities Market and Fujian's Putian footwear clusters. These markets all epitomized the raw, unrestrained expansion characteristic of China's early-stage economic development—unpolished yet vibrant byproducts of a society rushing toward modernization.

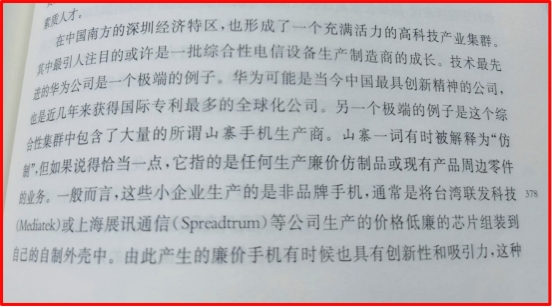

Barry Naughton's discussion of "Shanzhai" in The Chinese Economy: Adaptation and Growth

In The Chinese Economy: Adaptation and Growth, Barry Naughton states that while "Shanzhai" is sometimes translated as "imitation," it more accurately refers to small-scale producers of low-cost Shanzhais or ancillary services for existing products. These firms assembled unbranded mobile phones by integrating budget MediaTek or Spreadtrum chips into custom-designed casings.

At the time, mainstream models from Nokia, HTC, Dopod, Motorola, and Samsung cost around 3,000 RMB—nearly three months' wages for an average Chinese worker. With strong demand for affordable feature phones, Shanzhai devices priced at just one-fifth to one-third of branded alternatives proved highly popular in rural China and less-developed global markets.

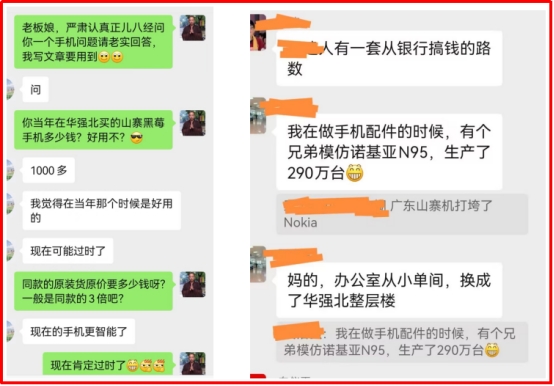

I once interviewed a female IC vendor in Huaqiangbei who proudly mentioned that her Shanzhai BlackBerry cost just over 1,000 RMB, while the official version retailed for around 4,000 RMB. She highlighted its solid performance—a key appeal for cost-conscious buyers.

Dubai in the UAE functioned as a critical transit point in this trade route. With its tax-free policies, strategic geographic location, and well-established distribution networks, Huaqiangbei's Shanzhai phones were typically shipped through Dubai before being re-exported to emerging markets such as India, Africa, and the Middle East.

Globally, annual smartphone sales peak at 1.2–1.3 billion units, with a global installed base of 3–4 billion devices. Estimates suggest Huaqiangbei’s Shanzhai phones have shipped over 1 billion units—accounting for more than a quarter of the world’s phone stock at their height. This phenomenon truly warrants serious attention.

As my friend Dai Hui, a veteran of the industry, observes:

"Shanzhai phones connected people to the world, improved lives, and drove social progress. In a real sense, they were a tremendous boon to society."

"Bits and Pieces of Memories: Shanzhai Phones from Huaqiangbei"

"Shanzhai" has long been synonymous with counterfeiting, low-quality manufacturing, controversy, and even intellectual property violations. In Huaqiangbei, it became particularly associated with overnight wealth stories.

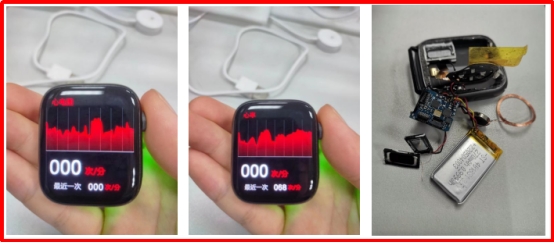

While many Shanzhai products could pass as genuine at first glance—with packaging and interfaces nearly indistinguishable from branded counterparts—their internal components often revealed shoddy craftsmanship. Disassembling them to examine PCBs and other details exposed appalling quality. This held true for Shanzhai phones, "white-label Bluetooth earbuds," and "Huaqiangbei smartwatches" alike.

Yet there was a silver lining. The Shanzhai phenomenon cultivated technical expertise, fostered innovation, nurtured maker talent, and developed industrial ecosystems in Huaqiangbei. It drove the evolution of Shenzhen's electronics supply chain, providing critical experience and resources that ultimately strengthened China's mobile phone industry.

Shanzhai phone manufacturers grappled with fierce industry competition and government crackdowns on intellectual property violations. Under this dual pressure, the majority collapsed. Only a handful endured—eventually evolving into major producers, exporters, or solution providers.

Teardown images of a Huaqiangbei Shanzhai smartwatch: identical exterior, substandard internals

II.Technological Evolution of Huaqiangbei Shanzhai Phones

The industry followed two technical routes: reverse-engineering and forward-oriented development. During the early feature phone era, reverse-engineering dominated. When a Nokia model sold well, manufacturers would purchase multiple units for disassembly, copying everything from casing dimensions and PCB layouts to BOM lists—even component specifications for capacitors, resistors, and TVS diodes. They also cracked the software code.

However, many lacked fundamental circuit knowledge, merely "copying the form without understanding the substance." This resulted in poorly made products that never improved or iterated. Yet their rock-bottom prices ensured profitability.

The second approach was forward-oriented imitation development. After early Shanzhai phone operations amassed significant capital and technical experience, the ecosystem began to transform. Engineers from established tech firms joined the sector, supply chain solutions diversified, and some manufacturers started adopting genuine forward design—developing products based on a thorough understanding of mobile communication fundamentals.

Many of these engineers brought specialized expertise from related industries. For example, personnel from Shajing’s Wang’s Electronics—a Toshiba cordless phone and Motorola brick phone OEM—already possessed mobile communication knowledge. Others came from PHS/pager developers like Runxun and Xianglong, with some engineers even transitioning from Huaqiangbei’s own pager sector. Technical talent from Taifeng Telecom (cordless phones), Guowei Electronics (in Liantang), and Elida Electronics (Nanyou, 2G communication) also joined the shift. These career-switchers far outperformed Huaqiangbei’s early 'guerrilla-style' operations in technical capability.

Shanzai! MediaTek and the White Box Handset Market Case Study Solution Analysis

It’s said that around 2003, when Meizu’s Huang Zhang was selling MP3 players in Huaqiangbei, he spotted untapped potential in China’s 3C market. Launching the nation’s first high-end MP3 player, he secured his first major fortune. This success spurred his move into smartphone development, and by 2009, the Meizu M8 sold over 100,000 units within two months, earning the title of "China’s Top Smartphone Brand."

The entry of established players like Meizu into the mobile sector triggered a technological and market leap for Huaqiangbei’s Shanzhai phones. Engineers from telecom giants joined the fray—ZTE veterans set up shop in the district, while former Bird smartphone team members launched startups. I even shared drinks with communication experts from Xidian University and Beijing University of Posts and Telecommunications in Huaqiangbei’s bars, a testament to the industry’s talent magnetism.

After MediaTek and Spreadtrum introduced their turnkey solutions—offering complete phone designs and chipsets to manufacturers—the industrial ecosystem of Huaqiangbei’s Shanzhai phones finally stabilized. Merchants in the district evolved from merely tweaking minor features to delivering end-to-end smartphone development, covering both hardware and software. This marked the true dawn of innovation in Huaqiangbei.

During that era, Shanzhai phones skyrocketed in popularity with distinctive features like dual-SIM dual-standby, extended battery life, and high-wattage speakers, carving out a unique market niche.

In 2006, Zhu Zhaojiang from Transsion Holdings demonstrated a profound understanding of the African market's needs. By optimizing algorithms to enhance the skin tones of black individuals in photographs, making them appear brighter, his team achieved a notable innovation. These pioneering efforts propelled Transsion to the esteemed position of "the King of Phones in Africa."

During the heyday of Shanzhai (knock-off) phones, over 2,000 phone design companies flourished around Huaqiangbei, specifically in areas such as Chegongmiao Industrial Zone, Tairan Industrial Zone, and the Southern Section of Nanshan Science and Technology Park. Concurrently, a comprehensive production supply chain for Shanzhai phones, centered around Huaqiangbei, developed across the Pearl River Delta region.

In October 2007, the Chinese government abolished the phone production approval system, which triggered the first major surge for Shanzhai phones in Huaqiangbei.

Soon after, over 20 phone brands emerged in Shenzhen, such as ZTE, Konka, Huawei, Skyworth, TCL, Malata, Kejian, Yulong Coolpad, Gionee, Transsion, Doov, Gaoke (SOP, previously known as Saiboyuhua), and more. Notably, several of these brands initially operated as Shanzhai phone manufacturers before evolving into established, branded entities.

During that period, renowned ODM companies within the Shanzhai phone supply chain included Huaqin, Longcheer, Huiye, Wingtech, Yude, Haipai, and Tinno. Meanwhile, the four leading official brands collaborating with China's three major telecom operators were collectively known as the "Zhonghua Cool Union" — comprising ZTE, Huawei, Coolpad, and Lenovo.

Later on, numerous integrated circuit enterprises from mainland China, including Spreadtrum, RDA Microelectronics, Awinic Technology, GalaxyCore Inc., Maxscend Microelectronics, Anyka Microelectronics, Goodix Technology, and Silead Inc., entered the mobile phone supply chain. Riding this wave, they rapidly expanded and grew into formidable market players.

I often jest that our company, Slkor (www.slkormicro.com), was established a tad too late — we missed out on that colossal influx of easy money!

The Shanzhai Nokia N95, a good seller in Huaqiangbei

In the early 21st century, mobile phone penetration in China was a mere 20%. Shenzhen streets were still dotted with card-operated phone booths, relics of a bygone era. Then came the Huaqiangbei Shanzhai phones—and mobile communication erupted in a wild, unrestrained frenzy, crushing the fixed-line phone industry like a steamroller flattening sandcastles. Legendary Shenzhen telecom giants like Elite (Yilida), Taifeng 888, and Guowei Electronics either collapsed or limped away, barely surviving.

I still chuckle recalling 1997: I bought an Ericsson GH388, strapped it to my belt in a leather holster, and strutted through Huaqiangbei like a peacock—six-pack abs of arrogance on full display. Back then, young Song Shiqiang (that’s me!) still had a full head of hair and the fire of rebellion in his belly. One night, after downing three bottles of Kingway beer beside DiFu Hotel and watching a rotund buddy puff through six "Good Day" cigarettes in a row, my heart raced like a Ferrari. I felt invincible, as if I could stomp the towering Qunxing Plaza into dust with my bare feet.

Later, when naming my company Kinghelm (www.kinghelm.net), inspiration struck from that very beer—Kingway. I tell foreign clients it means "The King’s Path"—the ultimate route to dominance. Hey, a guy’s gotta dream big, right?

At its heyday, the research and development cycle for a brand-new copycat phone in Huaqiangbei was shortened from 18 months to just 3 months. Every day, three new phone models were launched, featuring appearances and functions that were virtually indistinguishable from those of genuine products.

Compared with official branded phones, the motherboard cost of a copycat phone was only one-third, while the entire phone was priced at roughly one-fourth. During this period, MediaTek (MTK) also rose rapidly, competing head-to-head with major chip companies such as Qualcomm, Broadcom, and Apple in the mobile phone market.

From 2007 to 2009, Huaqiangbei's copycat phone manufacturers shipped approximately 150 million phones annually, with about 80% exported worldwide. This was the period when Huaqiangbei spawned the most billionaires, spanning the entire industrial ecosystem, including chip suppliers, battery makers, mold manufacturers, PCB designers, SMT assemblers, assembly lines, testers, packagers, sellers, and after-sales repair services. Those who joined at the right time reaped substantial profits.

The black market for Palm "shanzhai phone" software on the "hi-pda" enthusiast forum.

We've just talked about the hardware aspect. Now, let's turn to the software—and frankly speaking, the software of Huaqiangbei's Shanzhai phones fell short compared to the originals.

In the early era of feature phones, the operating system's user interface (UI) was relatively straightforward. Once the original software was cracked, people would tweak the UI slightly, install the required drivers, buy a generic phone casing,PCBA and peripheral accessories, screw everything together, and there you had it—a Shanzhai phone was complete. This was the early technological approach employed by Huaqiangbei's Shanzhai phone makers.

Back then, on the "hi-pda" enthusiast forum, there was an underground black market for Palm "Shanzhai phone" software, where a variety of software and plug-ins could be openly bought. Many of these enthusiasts later became avid fans of Xiaomi and were among Lei Jun's first batch of customers—but that's another story.

Later on, this spurred the emergence of many unique technologies and supporting services for Shanzhai mobile phone accessories in Huaqiangbei. People in the industry referred to this as "eating Nokia" and "chewing Apple." For instance, there was the practice of "jailbreaking"—removing some restrictions from the original phone firmware to install cracked software.

There were also small inventions and improvements in mobile phone accessories, such as phone cases, stands, and screen protectors, which all sold well. Additionally, power banks were developed and produced to address the iPhone's insufficient battery life, becoming a significant industry.

When the era of smartphones arrived, technological advancements in Huaqiangbei also kept pace. With Apple's iOS operating system and Android's software ecosystem, the folks in Huaqiangbei managed to get a slice of the pie as well.

III.The Two Development Peaks of "Huaqiangbei Shanzhai Phones"

Shenzhen's Huaqiangbei ascended to the throne as the "Electronics Capital," with the proliferation of "Shanzhai phones" playing a pivotal role in this achievement. The year 2007 marked the watershed between the two peaks of prosperity for "Huaqiangbei Shanzhai phones." Before 2007, it was the era of feature phones; after 2007, it transitioned into the era of smartphones. Huaqiangbei's Shanzhai phones surged alongside the explosive growth of the mobile phone market.

Back then, well-known mobile phone brands such as Motorola, Samsung, Nokia, HTC, and Dopod were priced at around 3,000 yuan. However, the industry witnessed the emergence of new chip giants like MediaTek and Spreadtrum. In particular, MediaTek introduced a "Turnkey solution," enabling factories to streamline the design process. This significantly accelerated the development cycle of new phones, reducing it from 18 months to a mere 3 months. The cost of the mainboard dropped to one-third of its previous level, while Huaqiangbei's Shanzhai phones were sold at roughly one-fourth the price of those big-name brands. At the peak of its boom, Huaqiangbei could unveil three new phone models every single day, with their appearances and functions so closely resembling the originals that many people couldn't distinguish the copies from the genuine articles.

Data indicates that in 2007, Huaqiangbei shipped 150 million Shanzhai mobile phones. In 2006, MediaTek (MTK) sold 100 million mobile phone chipsets to the Chinese mainland, with nearly all of them being utilized in Shanzhai phones, and approximately 70 million of these phones were exported. Owing to its successful business model, MediaTek was able to establish itself as a formidable competitor alongside major U.S. companies such as Qualcomm, Broadcom, and Apple in the global mobile phone market.

From 2007 to 2009, Huaqiangbei shipped approximately 150 million Shanzhai mobile phones annually, with around 80% of them being exported worldwide. This era marked the peak of millionaire creation in Huaqiangbei, encompassing participants across the entire industrial ecosystem—from chip and battery manufacturers to mold makers, PCBA solution providers, SMT assembly facilities, assembly workers, testing teams, and sales personnel. Driven by profit motives, some refurbished phones (overseas-returned devices) also flooded the Huaqiangbei market, though users could identify them by checking the production serial numbers.

Among the Shanzhai phones in Huaqiangbei, Nokia-inspired models were the top sellers, followed by those mimicking Samsung and Motorola. Counterfeit versions of Nokia's N92, N72, N8810, and N8850 models achieved massive sales volumes. Later, when slide-phone designs surged in popularity around 2007, knockoffs of Motorola's E66 and Samsung's SGH-D880 also became bestsellers in Huaqiangbei. Leveraging MediaTek's turnkey solutions, which provided end-to-end services, a single IC model—MTK6226—was widely adopted in Huaqiangbei's white-label phones, marking a resounding commercial success. Sensing the lucrative opportunity, domestic chipmaker Spreadtrum swiftly followed suit, capturing a share of the low-end market segment.

Building on MediaTek and Spreadtrum's solutions, Huaqiangbei's Shanzhai phone makers introduced their own small yet innovative features: dual-SIM single-standby functionality, reverse charging, amplified speaker volume, enhanced FM radio reception, and more. Coupled with their dominant distribution channels and competitive pricing, these phones became wildly popular. Brands like G’Five and Transsion targeted overseas markets, achieving remarkable success in Southeast Asia and Africa. Transsion, carrying Huaqiangbei's DNA, tailored its innovations specifically for Africa—optimizing camera algorithms for darker skin tones and incorporating large-capacity batteries to address frequent power outages. This strategy propelled it to become the undisputed "King of Phones in Africa."

"Shanzhai Archeology - Harvard Business Review" listed the innovative appearances of Huaqiangbei's Shanzhai phones

In 2009, China Unicom introduced the Apple iPhone to the Chinese market, marking the dawn of the smartphone era and igniting transformative changes. By 2011, with the launch of Apple's generation-4 iPhone, the market witnessed explosive growth. That year, the "luxury gold" iPhone became a sensation in Huaqiangbei—despite long queues, demand far outstripped supply. However, at that time, Huaqiangbei had yet to master the production of high-fidelity counterfeit iPhones.

At a critical juncture, MediaTek (MTK) delivered once again. Between 2011 and 2012, it unveiled a series of highly acclaimed chipsets—MTK6573, MTK6575, and MTK6577—officially propelling Shanzhai manufacturers into the smartphone arena. After two years of dormancy, Huaqiangbei’s Shanzhai phone market roared back to life, reaching its zenith. Bolstered by Android ecosystem solution providers like Wingtech, Huaqin, and Longcheer, along with support from Huawei’s and Foxconn’s supply chains, many Huaqiangbei entrepreneurs amassed substantial fortunes.

Apple's iOS system was relatively closed and hard to replicate, leaving Huaqiangbei's players with limited options—they mostly resorted to selling refurbished iPhones and gray-market imports from overseas. Yet the iPhone's profit margins were simply too alluring, prompting some ingenious minds to devise a bold workaround: they built an iOS-like interface and experience on top of Android, achieving such authenticity that even many users couldn’t spot the difference. This episode once again underscored the remarkable ingenuity of Huaqiangbei’s Shanzhai phone ecosystem.

Coming soon: 'Research on Huaqiangbei Shanzhai Phones' (Parts II & III)!

Don’t miss it!

Slkor HQ Reception with Song-Dynasty-Style Design

About the Author

Mr. Song Shiqiang serves as a popular science lecturer for the China Institute of Electronics and is a member of the Electronic Information Expert Database of the China Association for Science and Technology. He is also a columnist specializing in popular science writing and an expert in Huaqiangbei business research.

Mr. Song has invested in and operates two companies in Shenzhen: Slkor Semiconductor Co., Ltd. (www.slkoric.com) and Kinghelm Electronics Co., Ltd. (www.kinghelm.net). The brands "SLKOR" and "Kinghelm" have garnered international recognition and a strong reputation.

Kinghelm, with its motto "Connecting the World," began by developing antennas for Beidou and GPS systems. The company has since expanded its product line to include microwave antennas, RF cables, and electrical signal connectors, embracing the era of intelligent connectivity where everything is interconnected.

Slkor, on the other hand, focuses on the research and development of power devices, sensors, and other semiconductor products. Together, these two companies provide services to over 20,000 customers worldwide.

Song Shiqiang (Slkor's Founder) in His Early-Stage Office in Huaqiangbei

Mr. Song Shiqiang has consistently shown a keen interest in and conducted in-depth research on Huaqiangbei, actively advocating for its development. His research articles on Huaqiangbei, including "Research on Huaqiangbei," "The Transformation and Development of Huaqiangbei," and "A Refutation of Bloomberg's News on Huaqiangbei," have been reposted by major media outlets such as the People's Daily App, Xinhua News Agency, Associated Press, and Yahoo News.

With extensive experience in the electronics industry, Mr. Song enjoys widespread recognition and influence in the semiconductor and Beidou navigation sectors. He has been tirelessly working to foster a more favorable business environment in Huaqiangbei, aspiring to establish it as a prominent emblem of China's Reform and Opening-up and a distinguished hallmark of Shenzhen's rapidly thriving economy.

Media Contact

Company Name: Shenzhen Kinghelm Electronics Co., Ltd.

Contact Person: Support

Email: Send Email

Phone: +86 0755-83975897

Address:18/F, Building T2, Lijincheng Center, Longhua

City: Shenzhen

Country: China

Website: www.kinghelm.net