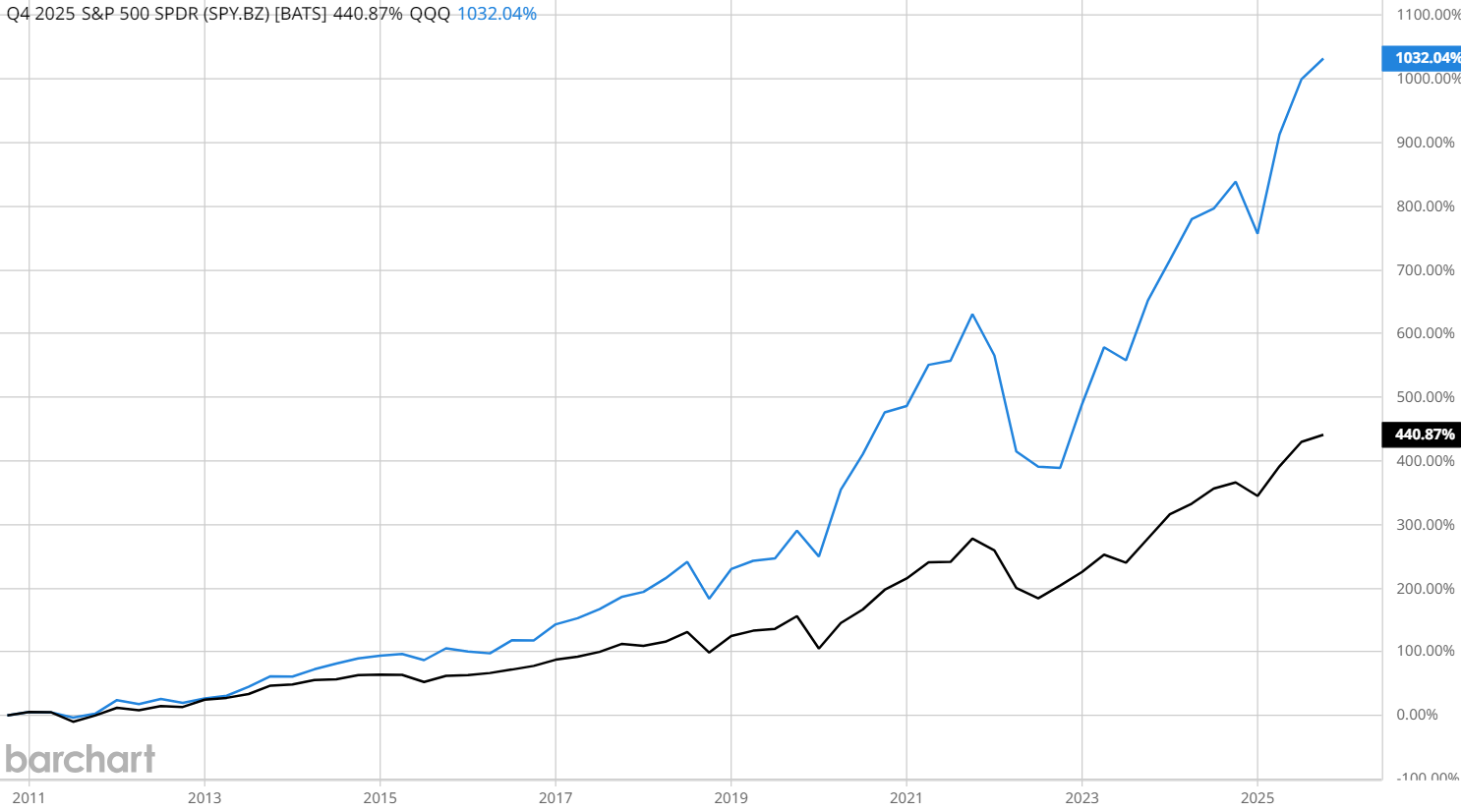

From a purely seasonal perspective, the November-April stretch is typically the strongest 6-month period for stocks. Since 2010, the broad-based SPDR S&P 500 ETF (SPY) has averaged a return of 3.09% for the month of November – its best monthly performance of the calendar year.

The QQQ Invesco ETF (QQQ) averages a similarly impressive 2.92% return for November, second only to July in terms of best monthly performance of the year for the benchmark.

Why This Time is Different

That’s why it was so remarkable when SPY just barely managed a positive monthly finish this past Friday, closing out the month up 0.19% for its weakest November performance since 2021.

QQQ, which skews heavily toward the mega-cap tech stocks that have been pierced by “AI bubble” fears in recent weeks, fared even worse; the exchange-traded fund (ETF) fell 1.56% for its first negative November since 2018 and its worst overall November return since 2011.

Interestingly, this follows a similar “funhouse mirror” seasonal effect in September-October. Both SPY and QQQ typically end the month of September in the red, but both closed convincingly higher in September 2025. Likewise, after ending the month of October negative in each of the preceding two years, SPY and QQQ broke their losing streaks to finish October 2025 in the green.

What’s Driving Markets Into Year-End?

By and large, the market is anticipating a Fed rate cut in December; without that, the investor outlook could sour, and the focus will shift back to the “wall of worry.”

That includes a laundry list of woes that has recently pushed consumer sentiment more or less to the brink: think inflation; the state of the job market as AI encroaches; the possibility of a systemic AI bubble; a sovereign debt crisis; the surging Japanese yen; the carry trade; intervention in Venezuela, and so on.

Looking further out, there could be another worry for bulls to add to the pile: 2026 midterm elections.

Markets Hate Uncertainty

Data from Bloomberg highlights a stark underperformance in equities during the 12 months leading up to a midterm election, followed by a significant outperformance after the election. This only serves to underline a principle most investors have likely heard, if not experienced firsthand – namely, that markets hate uncertainty.

Based on recent history, we could be looking at anything from a double-digit drawdown to a long, slow grind to relatively average returns through the November 2026 midterm elections. However, investors should take note of the conflict between the macro-level overhang of midterms and the traditionally bullish seasonality of the November-April period, and take care to monitor market momentum actively while also avoiding unnecessary risk.

– John Rowland, CMT, is Barchart’s Senior Market Strategist and host of Market on Close.

On the date of publication, Barchart Insights did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart

- Q4 Seasonality Feels Different. Don’t Miss This Major Overhang for Markets in 2026.

- This Options Strategy Turns Your Stock Portfolio Into a Consistent Income Generator

- Big Money is Betting on Natural Gas Prices to Break Out. Here’s the Setup.

- These Stock Charts Filter Out the Noise So You Can Focus on Price. Here’s What Trend Traders Need to Know.