Have you ever found yourself looking at dividend stocks, only to focus on yield?

Many investors love the idea of income investing, but don’t always have a clear process for choosing the right names. Those who’ve read my work know my picks often come from the Dividend Kings and Aristocrats lists, which include some of my favorite income stocks to research.

But yield is only half the story. Some Dividend Aristocrats are showing signs they could be gearing up for a bigger move in the months ahead.

So today, I’m looking at three Dividend Aristocrats with the highest current yields, along with the upside analysts see for each one. After all, who doesn’t like income with a potential pop on the side?

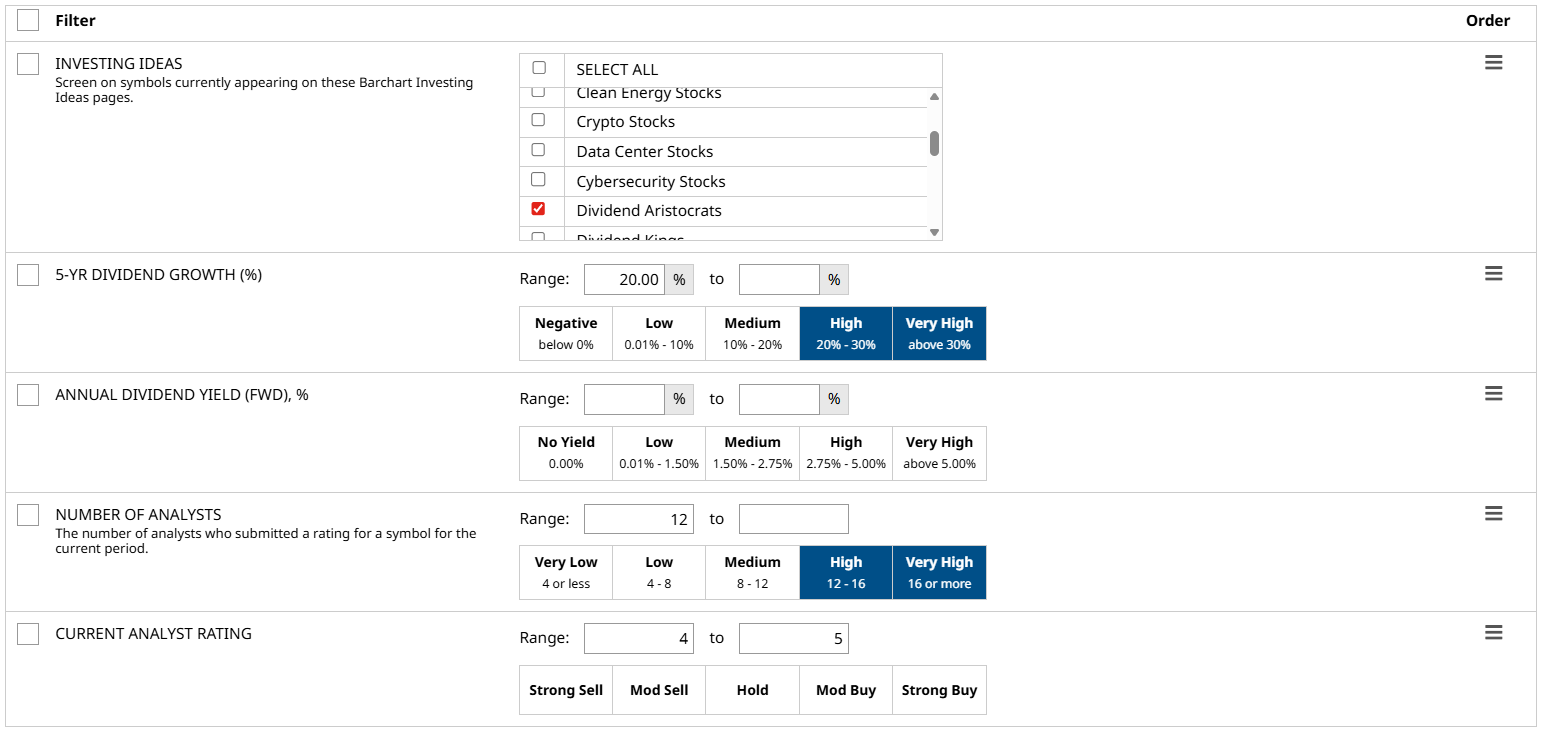

How I Came Up With The List Of Companies

- Investing Ideas: Dividend Aristocrats

- 5-YR Dividend Growth: Some companies increase dividends for as little as one cent per year to retain the title. So I set this filter to more than 20% to see companies with a record of substantial increases.

- Annual Dividend Yield (FWD): I intentionally set this blank to see the entire spectrum of companies with varying forward dividend yield.

- Current Analyst Rating: 4 to 5, or Moderate Buy, but very close to Strong Buy, and Strong Buy rating. To only see companies with a positive general consensus.

- Number of Analysts: I set this to 12 or above. The more analysts covering the company means a more reliable consensus rating.

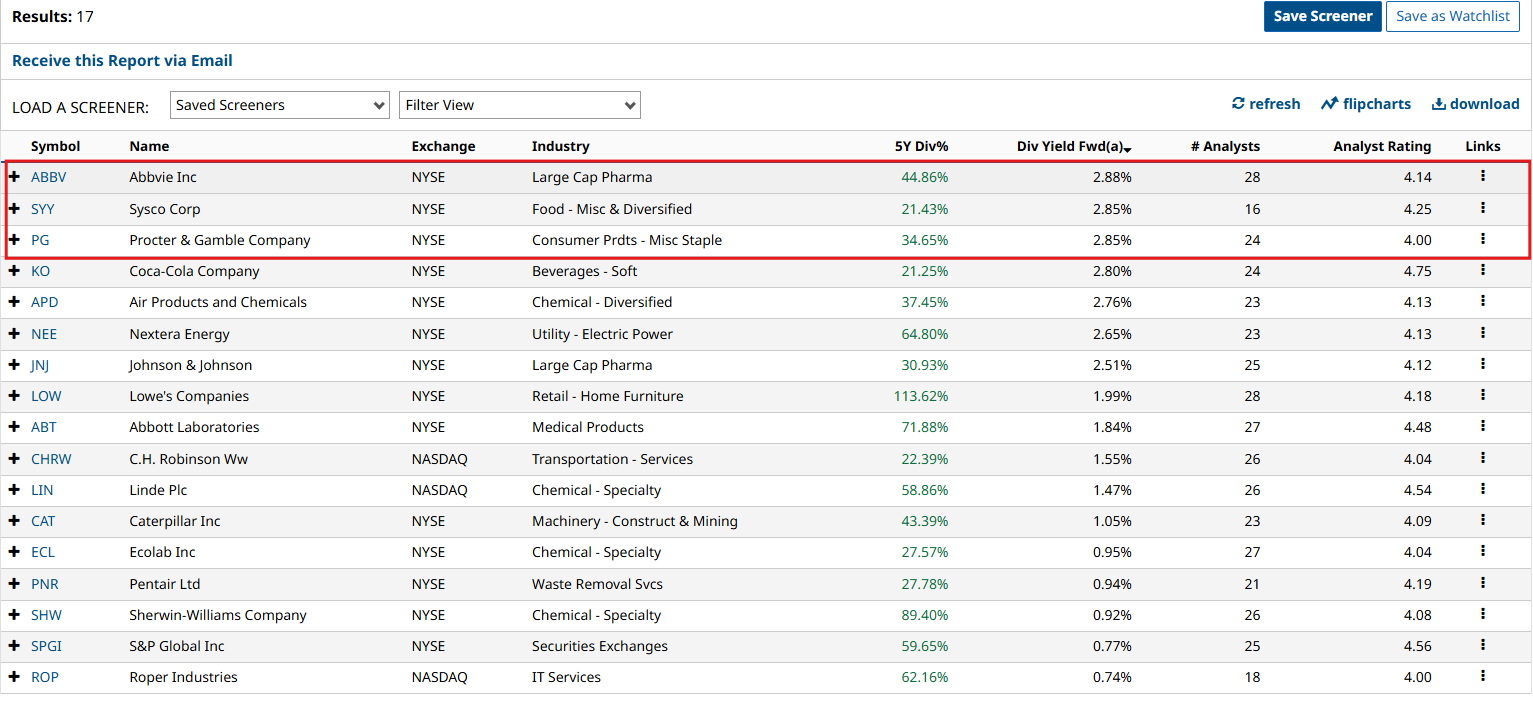

After running the filters, I was left with 17 Dividend Aristocrats. Then, I sorted them out from highest to lowest forward dividend yield, as I got my top 3 Dividend Aristocrats with the highest dividend yield potential. Starting with…

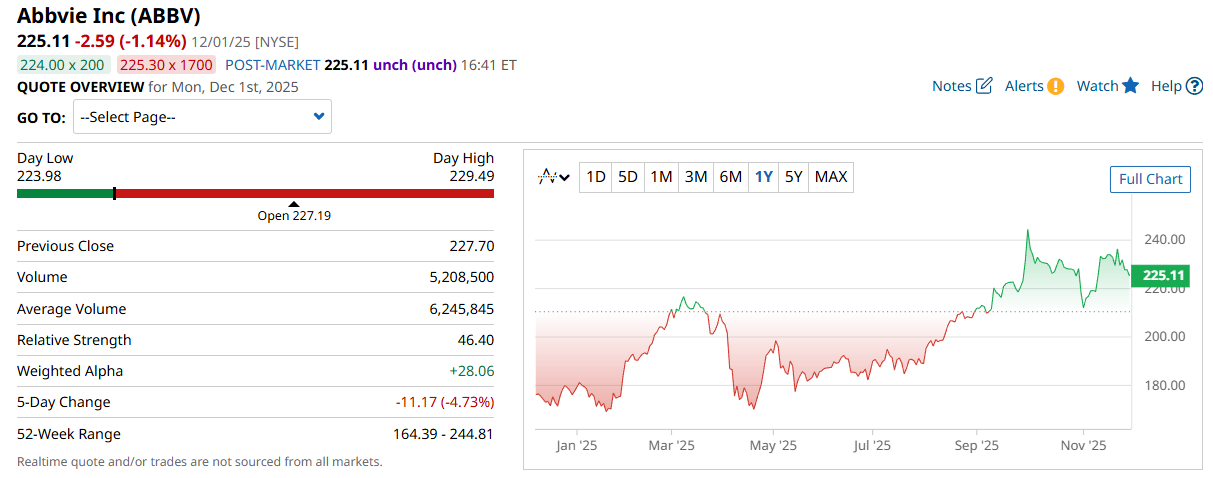

Abbvie Inc (ABBV)

The first is AbbVie, a healthcare company that develops drugs for conditions such as cancer and immune disorders. On top of that, AbbVie also manufactures traditional medicines and more advanced therapies for people with complex conditions such as chronic diseases.

In terms of share prices, AbbVie stock trades at around $255 per share and has gained roughly 112% over the past 5 years. Over the same period, the company’s dividend payout has increased nearly 45%.

Today, AbbVie pays an annualized dividend of $6.56, or $1.64 every quarter, which translates to a forward yield of almost 2.9%. Meanwhile, the payout ratio is 68.08%, so it’s still within a very acceptable range.

Financials-wise, annual revenue rose 3.7% to $4.28 billion compared to the same period last year. However, net income declined 12% to $4.27 billion, or $2.40 per share as a result of higher year-over-year interest expenses.

Even so, a consensus among 48 analysts rates AbbVie a Moderate Buy with a score of 4.14 out of 5. Over the past 3 months, this score has stayed relatively stable. The high price target is $289 per share, which suggests as much as 28% upside potential from current levels. Bottom line, with AbbVie, you get a potential for both dividend and capital growth.

Sysco Corp (SYY)

The next on the list is Sysco Corp, a company that delivers food and kitchen supplies to restaurants, hospitals, schools, hotels, and more. They’re basically the middlemen between the food producers and the places we often eat. They also handle all logistics for the distribution process.

Today, Sysco stock trades at nearly $76 per share; however, it has recently experienced some notable volatility. Dividend-wise, Sysco pays an annualized dividend of $2.16 per share, or $0.540 every quarter. This translates to a forward dividend yield of almost 2.9% and the company's payout ratio is 45.69%, which is very acceptable.

The company’s most recent annual revenue rose 3.2% to $81.37 billion, while net income declined 6.5% to $1.82 billion, or $3.74 per share (basic), like AbbVie, due to relatively higher interest and operating expenses.

According to a consensus among 16 analysts, the average rating for Sysco is also a Moderate Buy with a score of 4.25 out of 5. Over the past 3 months, this rating has been stable, but the score has gradually declined. Meanwhile, the high price target is $98 per share, implying about 30% upside from where it is now.

Procter & Gamble Company (PG)

The 3rd on my list is Procter & Gamble, a company that just about everyone knows. They make everyday household products that we probably use without thinking about it. They manufacture cleaning supplies, personal care items like Gillette, baby products like Pampers, and those consumer goods that end up in bathrooms and laundries around the world.

P&G last closed at $147.44 per share and has been on an upward trend despite recent volatility. The company pays an annualized dividend of $4.23, or $1.057 per quarter, which translates to a yield of nearly 2.9%. The dividend payout ratio is also very acceptable at 57.32% of its earnings. Over the past 5 years, the company’s dividend has increased by 34.65%.

In terms of financials, annual revenue rose about 0.3% to $84.28 billion, while net income rose 7.35% to $15.97 billion, or $6.67 per share (basic).

A total of 24 analysts rate the stock a Moderate Buy with an average score of 4 out of 5, stable over the past 3 months. The high target for the stock is $181 per share, suggesting as much as 23% upside for new investors.

Final Thoughts

The Aristocrats I mentioned above are definitely among the most compelling options for investors seeking income potential and long-term growth. However, the market can be brutal even to the most established companies, so I’d always recommend examining these companies from various angles. Look into the prospects, what management expects, and the current position.

On the date of publication, Rick Orford did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart